[ad_1]

The Federal Reserve ought to declare a direct stop fireplace in its struggle in opposition to inflation and maintain its benchmark rate of interest regular as an alternative of elevating the federal funds by a half share level to a variety of 4.25% to 4.50%, as anticipated at its assembly that ends Wednesday.

With the relatively benign report on the patron value index in November launched on Tuesday, the Fed has now has “compelling proof” that it has achieved its instant purpose of seeing a big slowing in inflation.

The CPI was higher than anticipated in November, with headline inflation rising simply 0.1% (1.2% annualized) and core inflation up 0.2% (2.4% annualized).

Learn: Inflation is slowing, but the fight is far from over

The U.S. inventory market

SPX,

DJIA,

COMP,

on Tuesday initially greeted the CPI report as affirmation that the Fed might start to let up, however by noon the realization hit that the Fed goes to maintain mountain climbing charges.

Market Snapshot: Dow clings to gain in final hour of trade as Wall Street gauges cooler inflation report, next Fed rate decision

Higher than the media says

The CPI report was truly higher than it’s being portrayed by the media, which proceed to focus irrationally on year-over-year adjustments in inflation relatively than what has occurred because the Fed started elevating rates of interest 9 months in the past. As an illustration, what are we to make of. this incoherent headline within the New York Instances: “U.S. Inflation Cools as Consumer Prices Rise 7.1 Percent”?

If we don’t wish to miss the turning factors, we have now to shorten our horizon to one thing lower than a 12 months, however not so brief that it’s all noise and no sign. Three months is about proper.

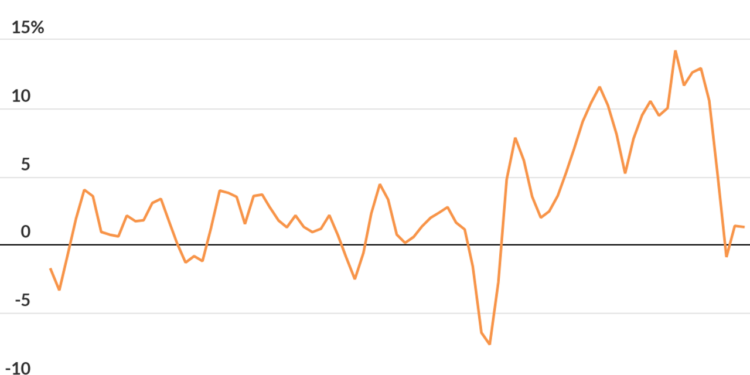

In March 2022, when the Fed first raised charges, inflation was accelerating. From January to March, the CPI had risen at an 11.3% annual fee. That was an alarming inflation fee which referred to as for motion by the Fed.

However then the Fed raised rates of interest at six straight conferences, going from close to zero to close 4% and now inflation is decelerating. From September to November, inflation rose at a 3.7% annual fee.

That’s vital progress in probably the most related measure of inflation.

Learn: Why November’s CPI data are seen as a ‘game-changer’ for financial markets

The mistaken perspective

The progress is way much less obvious when the figures are reported on a year-over-year foundation, as most media outlets do. From November 2021 to November 2022, inflation rose 7.1% — however that determine is meaningless to our understanding of what the Fed has achieved as a result of that time-frame additionally consists of 5 months of excessive inflation from earlier than the Fed acted.

As a result of fee hikes take a while to have an effect on costs and on the financial system, they didn’t actually begin to chew till July. Within the 5 months since then, inflation has slowed to a 2.5% annualized fee, noticeable to anybody who’s wanting. The unprecedented rise in rates of interest is working to chill off value will increase.

The progress is even better once you take into consideration that nearly all the inflation we’ve suffered lately is coming from increased rents, which are actually rising at a ten% annual fee in a lagged response to final 12 months’s unimaginable 20%+ improve in dwelling costs and tight rental markets.

Rents nonetheless rising as dwelling costs fall

House costs have now begun to fall in most areas of the U.S. Rents for brand new tenants have additionally begun to fall, however rents paid by persevering with tenants have lagged behind and will take one other 12 months or longer to catch up, in line with analysis by economists at Goldman Sachs. That’s as a result of rents on current leases are likely to reset on an annual foundation.

“ Rents are used to compute the prices not solely of renters however of householders as effectively. It’s as if we measured champagne costs by how a lot beer prices. ”

With greater than 900,000 multifamily housing models now underneath development, the provision constraints will quickly start to ease, decreasing stress on rents, when these models hit the market, probably within the subsequent 12 months or so.

Rents have an outsized affect on the CPI, as a result of rents are used to compute the prices not solely of renters however of householders as effectively. It’s as if we measured champagne costs by how a lot beer prices. Sure, there’s some correlation more often than not, however not all the time.

Utilizing rents to measure owners’ prices could be a suitable methodology in regular instances, however not now. Based mostly on the rise in rents, the CPI confirmed that shelter prices for owners rose at a 8% annual fee in November. Nobody believes that’s true. Most owners have a fixed-rate mortgage, so principal and curiosity funds haven’t gone up.

The appropriate perspective

One of the best factor to do on this scenario is to acknowledge that we have to exclude shelter prices (which accounts for a 3rd of the CPI) if we wish to see the place underlying inflation is heading.

“Substantial disagreement concerning the right solution to measure shelter inflation argues for inflation measures that put much less weight on shelter inflation, no more, when the choice is of better consequence,” wrote Goldman Sachs economists Ronnie Walker and David Mericle in a notice printed in October.

The CPI excluding shelter fell 0.2% in November and has risen at only a 1.3% annual fee over the previous three months.

Even Fed Chair Jerome Powell has acknowledged {that a} sudden drop in dwelling costs gained’t present up within the headline CPI for months, however he’s not performing like he fairly believes it. If he did, he’d urge his colleagues on the Fed to pause now and let the total impression of 375 foundation factors of tightening work on the financial system.

Extra: Fed seen slowing down to quarter-point hike in February after soft consumer price inflation reading

We all know, nevertheless, that the Fed gained’t pause. The Fed misplaced an excessive amount of credibility final 12 months when it missed the fast improve in inflation because the financial system emerged from its pandemic lockdown, and now the Fed is scrambling to revive the general public’s belief as an inflation fighter.

Sadly, that makes a recession practically inevitable, as a result of the Fed goes to do what it all the time does: Increase charges too far and push the financial system right into a job-killing recession.

Rex Nutting is a columnist for MarketWatch who has been writing concerning the Fed and the financial system for greater than 25 years.

Rex Nutting on inflation

What NASA knows about soft landings that the Federal Reserve doesn’t

Bigger paychecks are good news for America’s working families. Why does it freak out the Fed?

[ad_2]

Source link