[ad_1]

The gloom cloaking the UK financial system is beginning to elevate, giving one other potential enhance to Prime Minister Rishi Sunak.

Article content material

(Bloomberg) — The gloom cloaking the UK financial system is beginning to elevate, giving one other potential enhance to Prime Minister Rishi Sunak.

Commercial 2

Article content material

Simply 4 months in the past, the Financial institution of England warned that Britain was going through its longest recession in a century and a collapse in residing requirements.

Article content material

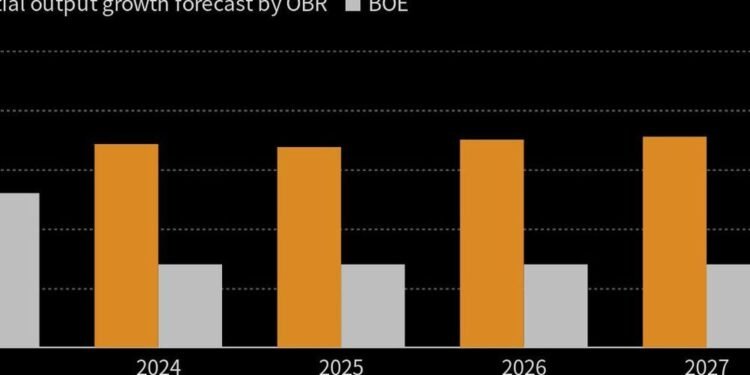

Neither is the case any longer. The BOE this week successfully canceled the recession and mentioned the interval of falling family incomes is over. That factors to a stronger backdrop for Sunak and the Conservatives within the yr or so main as much as the subsequent election.

“The prospects for the financial system by way of progress at the moment are significantly higher, and I feel it’s cheap to say there’s a fairly sturdy chance that we are going to keep away from a recession this yr,” BOE Governor Andrew Bailey instructed the BBC on Friday.

Sunak should name an election by early 2025 and has been trailing the opposition Labour Occasion in polls since he took workplace in October. That hole has narrowed as Sunak’s authorities stopped the turmoil that introduced down his predecessor, Liz Truss.

Commercial 3

Article content material

Stronger progress and decrease inflation would assist Sunak, who made serving to individuals climate the cost-of-living disaster one in every of his key priorities. Britain alone within the Group of Seven has but to regain its pre-pandemic degree of output, and wages are falling additional behind inflation. It additionally would assist the Treasury’s funds.

Most measures of UK financial prospects are bettering. Alongside its quarter-point hike in rates of interest to 4.25% on Thursday, the BOE upgraded its progress forecast for the three months to June to indicate gross home product rising “barely” as a substitute of contracting 0.4%.

Employment is forecast to develop 0.2% within the second quarter, not drop 0.4% as predicted in February. Actual family disposable incomes may “stay broadly flat within the close to time period, quite than falling considerably,” the minutes to this week’s Financial Coverage Committee price assembly mentioned.

Article content material

Commercial 4

Article content material

These figures recommend that households will quickly really feel higher off, regardless of the present 10.4% degree of inflation.

- In April, the authorized minimal wage rises 9.7% to £10.42 ($12.74) an hour, and advantages rise 10.1%.

- That very same month, inflation will drop into single digits and “fall sharply over the remainder of the yr” as falling vitality costs and extra favorable comparisons with a yr in the past feed by means of, the BOE mentioned.

- Annual vitality prices for the standard family will stay capped at £2,500 in April and are heading in the right direction to fall to about £1,800 in July.

- Households may even really feel richer just because they spend much less on vitality in spring and summer season as they don’t warmth their properties.

Previous progress has additionally proved stronger than projected. In November, output was forecast to shrink 0.3% within the last quarter of 2022. As a substitute, it flatlined. Personal-sector exercise, as measured by the buying managers’ index, is constructive, with order books rising and confidence at its highest degree because the invasion of Ukraine 13 months in the past.

Commercial 5

Article content material

The intently watched survey added to “indicators {that a} near-term recession has been averted,” Chris Williamson, chief enterprise economist at S&P International Market Intelligence, mentioned Friday.

Shopper confidence is bettering, and retail gross sales recovered in February to pre-Covid ranges regardless of an 18% improve in meals and non-alcoholic drinks costs over the previous yr.

The financial system’s resilience has taken forecasters without warning, given the file phrases of commerce shock brought on by vitality costs and the quickest financial tightening because the late Nineteen Eighties, because the BOE raised charges from 0.1% to 4.25% in 16 months.

The final equal phrases of commerce shock within the Seventies did trigger a recession, as did the speed rises of late Nineteen Eighties.

Kallum Pickering, UK economist at Berenberg Financial institution, mentioned the distinction this time has been the UK’s lowered reliance on pure gasoline and the power of each family and company steadiness sheets, because of financial savings amassed throughout Covid. These financial savings have insulated the financial system towards price hikes.

Commercial 6

Article content material

The energy-price shock has been much less extreme than anticipated as a result of the UK has managed to function with 15% much less gasoline than earlier years, in response to Pickering’s calculations utilizing knowledge introduced by the Workplace for Funds Duty at this month’s funds.

The fiscal loosening within the funds is predicted so as to add 0.3% to GDP and cut back headline inflation, the BOE mentioned. Now {that a} deal over the Northern Eire Protocol has been agreed with the European Union and the prospect of a Scottish referendum receding, the funding local weather has additionally improved.

“For the primary time in seven years we’ve got no populists within the UK,” Pickering mentioned. Rather than his forecast final autumn for a recession wherein the financial system shrank 2.5%, he now expects “stagflation with a robust labor market quite than recession.”

Commercial 7

Article content material

The stronger financial outlook makes at the least one additional price rise to 4.5% seemingly, Andrew Goodwin, UK economist at Oxford Economics, mentioned. Markets are priced for a 4.5% terminal price.

There are dangers to the outlook, primarily from the continued turbulence within the banking sector and monetary markets — with Deutsche Financial institution the most recent establishment going through difficulties. Additional setbacks may drive up financial institution funding prices that “end in a tightening in monetary circumstances” and harm progress prospects, Pickering mentioned.

The BOE has burdened that UK banks are “protected and sound” and can present a well timed replace subsequent on Tuesday, when Bailey and Prudential Regulation Authority Chief Government Sam Woods testify to Parliament in regards to the rescue of Silicon Valley Financial institution’s UK operation. It was bought to HSBC for £1 earlier this month after a deposit run that noticed £2.9 billion withdrawn by prospects in a day.

Commercial 8

Article content material

Catherine Mann, a BOE coverage maker, mentioned the banking and monetary market turbulence may affect the BOE’s forthcoming rate of interest selections, a touch that even she would possibly quickly be able to pause the quickest financial tightening in three a long time.

If larger perceived credit score threat result in tighter monetary circumstances, that will probably be “on the plate” within the Might resolution because it “would have the identical impact as a financial institution price rise.”

“We will probably be getting knowledge in actual time in regards to the monetary circumstances, credit score circumstances, and if they’re tightened … we’ll take that under consideration,” Mann mentioned.

—With help from Tom Rees and Lucy White.

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail when you obtain a reply to your remark, there’s an replace to a remark thread you observe or if a person you observe feedback. Go to our Community Guidelines for extra data and particulars on methods to regulate your email settings.

Be part of the Dialog