[ad_1]

US inflation was largely unwavering in March, with economists projecting a month-to-month improve in shopper costs on par with advances seen over the earlier half 12 months that may take a look at the Federal Reserve’s mettle.

Article content material

(Bloomberg) — US inflation was largely unwavering in March, with economists projecting a month-to-month improve in shopper costs on par with advances seen over the earlier half 12 months that may take a look at the Federal Reserve’s mettle.

Commercial 2

Article content material

Authorities figures Wednesday are anticipated to indicate a 0.4% month-to-month achieve within the core shopper worth index, which excludes meals and power and higher displays the scope of underlying inflation dealing with American households.

Article content material

Whereas softer than the 0.5% advance within the prior month, such a rise would match the September-February common and retains year-on-year figures stubbornly excessive. Which will assist tip the scales towards one other rate of interest hike on the Fed’s Might assembly, regardless of stress within the banking system and indicators of a slowing financial system.

In the meantime, minutes of the Fed’s March 21-22 assembly, additionally launched on Wednesday, could present clues concerning the urge for food for additional coverage tightening in addition to views on the well being of the banking system and lending.

Commercial 3

Article content material

The Fed’s talking calendar is busy within the coming week and contains appearances by regional financial institution presidents John Williams, Patrick Harker, Austan Goolsbee, Neel Kashkari and Thomas Barkin.

US core CPI is seen rising 5.6% from a 12 months in the past, which might be an acceleration from February’s annual achieve. Together with meals and gas, the value gauge is forecast to climb by 5.1%, the smallest advance in practically two years. The central financial institution’s objective, based mostly on a unique inflation metric, is 2%.

Since hovering to a four-decade excessive of 9.1%, the general CPI has been retreating consistent with falling power costs. These prices, nonetheless, could begin to rise once more after the OPEC+ announcement on April 2 of a shock lower in crude manufacturing. Rising crude oil costs could bleed by means of to gasoline and jet gas simply as People start their summer season trip planning.

Article content material

Commercial 4

Article content material

Learn extra: Oil Value Jolt Compounds Inflation Puzzle for Central Banks

Amongst different US financial stories, the federal government will launch March retail gross sales. Economists mission gross sales fell for the fourth time previously 5 months, with excessive inflation restraining items purchases and shoppers allocating extra of their discretionary incomes to providers.

What Bloomberg Economics Says:

“The March CPI report will supply glimmers of fine information on disinflation. Plunging pure gasoline costs in California, aided by a state authorities credit score, helped. However the items information is probably going transitory – oil costs are rising once more after OPEC+ introduced manufacturing cuts. If that leads to persistently rising gasoline costs, it may offset any disinflation beneficial properties within the subsequent few months.”

Commercial 5

Article content material

—Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church, economists. For full evaluation, click on right here

Elsewhere, Washington will steal the limelight as finance ministers and central bankers flock there for spring conferences of the Worldwide Financial Fund and World Financial institution. The IMF’s new financial forecast will likely be revealed on Tuesday, whereas a Group of 20 gathering of finance chiefs begins the subsequent day.

In the meantime, central banks in Canada, South Korea and Peru could all preserve charges unchanged within the coming days.

Click on right here for what occurred final week and beneath is our wrap of what’s arising within the world financial system.

Canada

Financial institution of Canada Governor Tiff Macklem will seemingly stick with the sidelines for a second time on Wednesday. He’s seen holding the benchmark in a single day price at a 15-year excessive of 4.5%, regardless of few indicators the financial system is gearing down.

Commercial 6

Article content material

Employment blew previous expectations for a fourth-straight month in March, with wage beneficial properties once more coming in past a stage policymakers view as in line with bringing inflation again to focus on. Financial progress within the first quarter can be monitoring properly past the financial institution’s projections.

Merchants will search for any shift in language round a willingness to hike once more if wanted, given monetary stability considerations which have probably shifted the steadiness of dangers. Swaps markets see the Financial institution of Canada’s subsequent seemingly transfer as a lower later this 12 months.

Macklem’s resolution will likely be launched alongside a brand new set of forecasts that may seemingly push again the timing of an anticipated stall, with inflation nonetheless falling to 2% a while subsequent 12 months. The governor will take questions from reporters afterward.

Commercial 7

Article content material

Asia

The Financial institution of Japan’s new Governor Kazuo Ueda begins his time period, inheriting a decade of huge stimulus coverage from Haruhiko Kuroda. He’s anticipated to go to the IMF Spring conferences with Finance Minister Shunichi Suzuki, taking part in his first high-profile worldwide convention as central financial institution chief.

On Tuesday, the Financial institution of Korea meets to ship its newest coverage resolution. Amid considerations over the financial progress and inflation, the Korean central financial institution could maintain its benchmark rate of interest regular once more, after it saved charges unchanged in February for the primary time in over a 12 months.

China’s inflation knowledge on Tuesday will seemingly present subdued worth pressures as progress slowly recovers, whereas commerce figures on Thursday are anticipated to indicate exports nonetheless contracting amid a hunch in world demand.

Commercial 8

Article content material

Australia’s jobs knowledge will likely be carefully watched on Thursday after central financial institution Governor Philip Lowe paused his year-long tightening marketing campaign.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

In every week shortened all through a lot of the area by the Easter vacation on Monday, the main focus is prone to be on Washington. A number of central-banker appearances are scheduled, with speeches by the governors of Spain, France and Germany, in addition to the Financial institution of England chief Andrew Bailey.

Information will likely be correspondingly mild. For the euro area, the spotlight could also be industrial manufacturing on Wednesday, which can give a sign of the power of progress through the second quarter. Closing estimates of inflation in main economies are additionally anticipated.

Commercial 9

Article content material

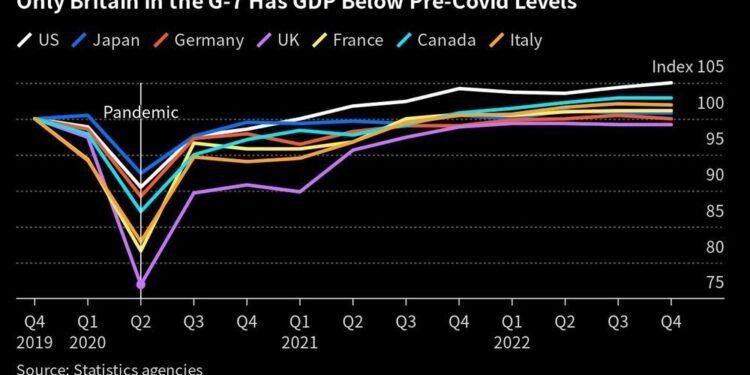

The UK, in the meantime, will launch month-to-month gross home product for February, which can give one other indication of whether or not a recession is being averted.

Turning to the Nordic area, inflation knowledge will likely be launched all through Scandinavia. Sweden’s quantity on Thursday could entice explicit focus, with a drop within the headline price anticipated, but that is probably not sufficient to discourage additional hikes in borrowing prices by the Riksbank.

Trying south, Egyptian inflation due Monday is prone to present one other acceleration however probably at a slower tempo after the state intervened on meals provides and moderated costs.

Information on Wednesday could present Ghana’s inflation price in March fell beneath 50% for the primary time in 5 months on the again of a steady forex and base results.

Commercial 10

Article content material

On Friday, knowledge from Nigeria will most likely present that worth progress softened in March, as a consequence of money shortages affecting the power to spend by companies and shoppers alike.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

If President Luiz Inacio Lula da Silva was livid at Brazil’s central financial institution over excessive charges when inflation was close to 6%, what occurs when it falls again to throughout the 1.75%-to-4.75% goal vary, as some economists anticipate with the March knowledge?

Exhausting to say, however Lula’s targeted on jump-starting the financial system of Latin America’s slumbering large, and so could also be lower than eager to listen to how base results are driving a brief however pronounced bout of disinflation and that year-end inflation of 6% is an effective guess.

Commercial 11

Article content material

The minutes of Banxico’s March assembly could do little greater than affirm the data-dependent stance policymakers adopted of their post-decision assertion, issued after a quarter-point hike to 11.25%.

Peru’s central financial institution on Thursday is prone to preserve its key price at 7.75% for a 3rd month. Julio Velarde, Latin America’s longest-serving central financial institution chief, mentioned in March that inflation within the Andean nation could properly fall again to the highest of the 1%-to-3% goal vary by year-end.

Wrapping up the week, Argentine inflation is broadly anticipated to have accelerated for a 14th month from February’s 102.5% studying, shaking off forex controls, a number of alternate charges and worth freezes on hundreds of things.

The median estimate of 17 analysts surveyed by Bloomberg places the year-end price at 100%, which might be the sixteenth triple-digit print since 1974.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Robert Jameson, Malcolm Scott, Michael Winfrey, Paul Richardson, Monique Vanek, Stephen Wicary and Erik Hertzberg.

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve got enabled electronic mail notifications—you’ll now obtain an electronic mail in case you obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra info and particulars on find out how to alter your email settings.

Be a part of the Dialog