[ad_1]

OPEC+’s shock oil-production minimize despatched shock waves by monetary markets and pushed crude costs up by probably the most in a yr. Now that the mud has began to settle, one query looms massive: Will that value rally stick, or fade away?

Article content material

(Bloomberg) — OPEC+’s shock oil-production minimize despatched shock waves by monetary markets and pushed crude costs up by probably the most in a yr. Now that the mud has began to settle, one query looms massive: Will that value rally stick, or fade away?

Commercial 2

Article content material

Banks from Goldman Sachs Group Inc. to RBC Capital Markets LLC raised their oil-price forecasts instantly after the OPEC+ minimize. But, many merchants nonetheless consider a souring financial outlook will block the group’s actions from pushing costs increased. Demand indicators are additionally beginning to flash warning indicators.

Article content material

It might find yourself being the final word check of what issues extra to the market: tighter provides, or the lackluster demand image. That can seemingly deliver extra uncertainty over the route of costs — a sophisticated improvement for the Federal Reserve and the world’s central bankers of their ongoing battle towards inflation.

“It’s a really onerous market to commerce proper now,” stated Livia Gallarati, a senior analyst at Power Elements. “When you’re a dealer, you might be pulled between what’s occurring at a macroeconomic degree and what’s occurring essentially. It’s two totally different instructions.”

Commercial 3

Article content material

Learn Extra: OPEC+ Shock Reduce Goals to Make Oil Speculators Assume Twice

One factor that’s sure: A significant shift of market management into the palms of Saudi Arabia and its allies has now been cemented, with large implications for geopolitics and the world’s financial system.

Traders have continued to reward US drillers for manufacturing self-discipline, making it unlikely that shale corporations will ever once more undertake the type of disruptive progress that helped to maintain power inflation tame final decade. That leaves the oil market beneath the purview of OPEC+ at a time when some specialists have predicted that demand is heading to a report.

“The shock OPEC cuts have already triggered fears of a resurgence in inflation,” stated Ryan Fitzmaurice, a lead index dealer at commodities brokerages Marex Group Plc. “These renewed inflation considerations ought to solely improve” within the months forward, he stated.

Article content material

Commercial 4

Article content material

Right here is an summary of what merchants will likely be watching within the oil market.

Summer time Demand

The timing of OPEC’s determination has struck an odd chord for a lot of oil specialists.

The manufacturing cuts don’t take impact till Could, and far of the repercussions are prone to be felt within the second half of the yr. That’s a time when oil demand sometimes reaches its seasonal peak, partly due to the busy summer time driving season within the US. It’s additionally the purpose when China’s financial reopening is anticipated to begin swinging into full gear, additional underpinning demand.

Usually, OPEC would wish to reap the benefits of that consumption burst by promoting into the market as a lot as attainable. As an alternative, the minimize means the cartel is holding again. That’s sparking debate about whether or not the transfer will find yourself driving oil costs to $100 a barrel as demand surges, or whether or not, as an alternative, the cartel and its allies are getting ready for a recession-marked summer time of tepid consumption.

Commercial 5

Article content material

“Whereas OPEC+ cuts on the floor are usually seen as bullish, it does additionally elevate considerations over the demand outlook,” stated Warren Patterson, head of commodities technique at ING. “If OPEC+ had been assured in a powerful demand outlook this yr, would they actually really feel the necessity to minimize provide?”

Strikes in world gas markets underscore the demand skepticism. Whereas oil costs rallied, strikes for refined merchandise had been much less pronounced, shrinking margins for refiners throughout Europe and the US. In Asia, costs of diesel, a key refinery product, are signaling heightened slowdown considerations as timespreads shrink to their lowest since November.

Elevated Stockpiles

Whereas US inventories have been declining, world inventories are nonetheless excessive.

Commercial 6

Article content material

Within the first quarter, business oil stockpiles held in OECD nations had been sitting about 8% above final yr’s ranges, in accordance with estimates from the US Power Data Administration. That’s a reasonably sizeable buffer and an indication of the weak spot in consumption that’s plagued the market prior to now few months.

“You do have to chew by that overhang first earlier than we are able to see we upside,” stated Gallarati of Power Elements.

Russian Flows

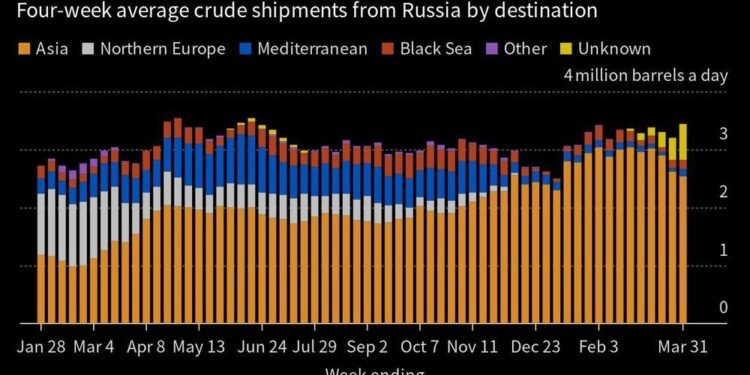

Oil bulls have waited in useless for a Russian output minimize promised for March to indicate up. The Kremlin stated it will slash manufacturing by 500,000 barrels a day in March in retaliation for import bans and value caps imposed by “unfriendly nations.” However there’s been no signal of decrease Russian output displaying up within the one measure that issues to world crude markets — the variety of barrels leaving the nation.

Commercial 7

Article content material

Crude shipments from Russia’s ports hit a brand new excessive within the last week of March, topping 4 million barrels a day. That’s 45% increased than the common seen within the eight weeks earlier than Moscow’s troops invaded Ukraine and has been boosted by the diversion since January of about 500,000 barrels a day delivered by pipeline on to Poland and Germany.

Shale’s Manufacturing Self-discipline

It wasn’t way back that there have been two main gamers that oil merchants turned to for route over provides: the Group of the Petroleum Exporting Nations and the US shale trade.

On the time, OPEC and shale had been locked in a battle for market share. It was a feud that helped to maintain world oil costs — and energy-driven inflation — at bay for the higher a part of decade.

Commercial 8

Article content material

Then the pandemic hit, and with it an oil value rout that suffocated the shale trade. For the final three years, even because the market recovered and money circulate surged, corporations have prioritized dividends and share buybacks over new drilling. It’s been a successful technique. Since March 2020, the S&P 500 Power Sector Index has surged nearly 200%, outpacing the S&P 500’s almost 60% acquire.

Now, as requires peak shale output collect tempo, OPEC has one much less issue to contemplate when making provide selections.

That’s a sore spot for President Joe Biden, who was fast to downplay the affect of the choice by the cartel and its allies to chop output by greater than 1 million barrels per day. Biden vowed after an preliminary manufacturing minimize final yr that there could be “penalties” for Saudi Arabia, however the administration has but to observe by.

Commercial 9

Article content material

Learn Extra: Traders Unloaded Saudi Arabian Bonds After Shock OPEC+ Transfer

Futures Curve

Discuss of $100 oil has been buzzing because the finish of final yr, nevertheless it looks as if the can retains getting kicked down the highway. First, some analysts had predicted costs would attain that threshold within the second quarter of 2023. The view obtained pushed into the second half of the yr, and now even a number of the greater bulls aren’t anticipating the magic quantity to come back into play till 2024.

The oil futures curve is reflecting these expectations. Costs for contracts tied to deliveries as far out as December 2024 and 2025 have rallied, at the same time as benchmark front-month futures are beginning to ease.

“The OPEC+ output minimize definitely raises the opportunity of $100 a barrel this yr, though it’s on no account a certainty,” stated Harry Altham, an analyst at brokerage StoneX. “Demand-side weak spot stemming from progress concerns is clearly taking a extra outstanding function.”

—With help from Julian Lee, Grant Smith, Chunzi Xu, Kevin Crowley and Mitchell Ferman.

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We have now enabled electronic mail notifications—you’ll now obtain an electronic mail in the event you obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Community Guidelines for extra info and particulars on find out how to alter your email settings.

Be a part of the Dialog