[ad_1]

A key measure of US inflation confirmed hints of moderating in March, however doubtless not by sufficient to dissuade the Federal Reserve from elevating rates of interest once more subsequent month.

![idr80[sk1n))ur}iw]qujr3a_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/04/underlying-inflation-elevated-with-some-signs-of-moderation-.jpg?quality=90&strip=all&w=288&h=216&sig=YAIKJIUEhhjlET_sr3QUBg)

Article content material

(Bloomberg) — A key measure of US inflation confirmed hints of moderating in March, however doubtless not by sufficient to dissuade the Federal Reserve from elevating rates of interest once more subsequent month.

Commercial 2

Article content material

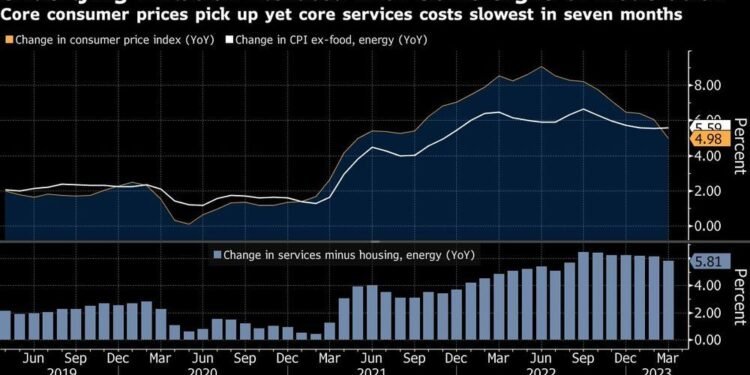

The core shopper value index — which excludes meals and power and is carefully watched by the Fed — rose 0.4% from the prior month following a 0.5% achieve, in step with economists’ estimates. But key measures of housing prices posted the smallest month-to-month will increase in a couple of 12 months and grocery costs dropped, the report from the Bureau of Labor Statistics confirmed.

Article content material

Buyers reacted positively to the report. Treasury yields tumbled, the S&P 500 opened increased and the greenback prolonged losses on the day. Merchants nonetheless largely wager on a 25 basis-point price hike on the Fed’s Might assembly.

Inflation, nevertheless, stays too excessive. The core CPI, which economists view as the higher indicator of underlying inflation, was up 5.6% from a 12 months in the past. It’s the primary time in over two years that the core got here in above the general measure, which was up 5%.

Article content material

Commercial 3

Article content material

That’s a pointy slowdown from the earlier month as a result of the determine is now in contrast with March 2022, when power costs spiked instantly after Russia’s invasion of Ukraine.

Comply with the response in actual time right here on Bloomberg’s TOPLive weblog

The report provides glimpses of disinflation forward even whereas highlighting the sticky nature of inflation — significantly inside the service sector. Whereas policymakers are carefully looking ahead to any signal that the most recent banking turmoil is weighing on the economic system, brisk shopper value positive aspects paired with a still-strong labor market are prone to lead the Fed to lift rates of interest at the very least as soon as extra earlier than what they are saying might be an prolonged pause.

“Might ought to nonetheless tilt to a hike,” mentioned Derek Tang, an economist at LH Meyer/Financial Coverage Analytics in Washington. “However it does take a few of the wind out of whether or not one other hike in June might be wanted in any respect.”

Commercial 4

Article content material

Learn extra: Fed Officers Sign Divide Over Whether or not to Hike Charges Once more

The main points confirmed shelter prices rose on the slowest tempo since November although remained “by far” the biggest contributor to the month-to-month advance, the report mentioned. Grocery costs fell for the primary time since September 2020 — together with the largest month-to-month drop in egg costs since 1987 — whereas the price of eating out continued to rise firmly.

So-called core items costs, which exclude meals and power commodities, rose 0.2%, probably the most since August. That’s a divergence from late final 12 months, when outright deflation on this class helped ease general value pressures.

Used-car costs declined in March, whereas airfares, family furnishings and motor-vehicle insurance coverage all rose.

Commercial 5

Article content material

Vitality costs fell 3.5%, reflecting declines in gasoline, pure gasoline and electrical energy. Nonetheless, the dip could show to be short-lived after OPEC+ introduced an oil manufacturing reduce earlier this month. Pump costs are actually on the highest since November.

What Bloomberg Economics Says…

“A robust disinflationary push is predicted from shelter over the summer season. Even so, given ongoing power within the labor market and the OPEC+ cuts — in addition to strain from labor-intensive providers industries — we count on the FOMC to hike charges by one other 25 foundation factors when it meets subsequent month.”

— Jonathan Church and Stuart Paul, economists

To learn the complete word, click on right here

Shelter prices, that are the largest providers part and make up a couple of third of the general CPI index, climbed 0.6%. Housing value measures superior on the slowest paces in a couple of 12 months whereas lodge costs jumped by probably the most since October.

Commercial 6

Article content material

Due to the best way the housing metrics are calculated, there’s a major lag between real-time value modifications and the federal government statistics. Different metrics counsel these gauges will quickly flip over, however economists are break up on the precise timing.

Excluding housing and power, service costs rose a agency 0.4%, in accordance with Bloomberg calculations. The metric was up 5.8% from a 12 months earlier, the bottom in seven months.

Fed Chair Jerome Powell and his colleagues have confused the significance of such a metric when assessing the nation’s inflation trajectory, although they compute it based mostly on a separate index. The Fed sees wage development as one of many main drivers of inflation on this class and is thus keenly attuned to any modifications in a wide range of pay metrics.

Commercial 7

Article content material

The minutes of the Fed’s March assembly, to be launched later Wednesday, will provide extra perception as to how policymakers balanced a string of financial institution failures with cussed value pressures.

The newest jobs report confirmed the tempo of earnings development has slowed in latest months to a price extra in step with the central financial institution’s 2% inflation goal. That mentioned, economists might be carefully watching the employment value index, which is considered as a cleaner and extra correct measure of pay development, out later this month.

A separate report out Wednesday confirmed actual common hourly earnings rose 0.2% in March, the primary enhance this 12 months, and had been down 0.7% from a 12 months earlier.

The CPI is likely one of the final main releases the Fed can have in hand earlier than its Might 2-3 assembly. Within the coming weeks, policymakers will even scrutinize wholesale inflation and retail figures in addition to different information together with inflation-adjusted shopper spending, the private consumption expenditures value index and the ECI.

—With help from Augusta Saraiva, Chris Middleton and Steve Matthews.

(Provides power costs and market open)

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We have now enabled e-mail notifications—you’ll now obtain an e-mail when you obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra info and particulars on how one can regulate your email settings.

Be part of the Dialog