[ad_1]

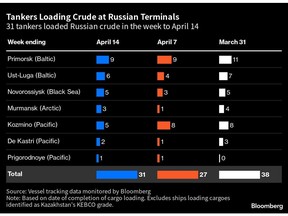

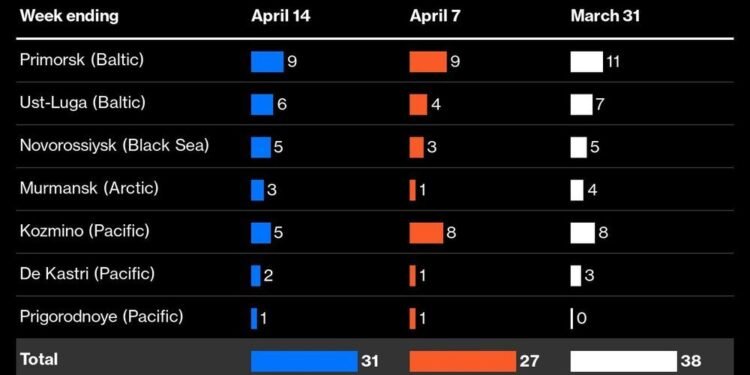

Seaborne flows climbed again above 3 million barrels a day in week to April 14

Article content material

(Bloomberg) — Russia’s crude oil exports bounced again, with the earlier week’s sharp decline proving short-lived.

Commercial 2

Article content material

Flows from Russian ports rose by 540,000 barrels a day, recovering rather less than half of the earlier week’s loss and climbing again above 3 million barrels a day, based on tanker-tracking information compiled by Bloomberg. The much less risky four-week common additionally edged larger.

Article content material

Moscow’s vitality ministry mentioned output was minimize by 700,000 barrels a day in March and the earlier week’s shipments have been in line with a decrease manufacturing stage. However the enhance in flows final week casts doubt on the dimensions of any output discount, notably as the rise got here from ports within the west of the nation, the place the burden of cuts is predicted to be felt. The one area the place flows fell was the Pacific, from the place voyages to Russia’s remaining prospects are shortest and export costs are highest.

Commercial 3

Article content material

The diversion of crude beforehand delivered to Poland and Germany by the Druzhba pipeline has boosted seaborne flows in the course of the early a part of this 12 months to a median of three.32 million barrels a day, in contrast with 2.94 million barrels a day in the course of the equal interval on the finish of 2022. Flows to Germany halted on the finish of 2022 and deliveries to Poland have been stopped in late February. Poland’s state-controlled oil refiner PKN Orlen SA has terminated its final contract with a Russian provider in response to the halt in oil shipments by way of Druzhba.

Russia’s Lifelines

The mixed quantity of crude on vessels heading to China and India plus smaller flows to Turkey and portions on ships that haven’t but proven a remaining vacation spot rebounded to three.31 million barrels a day within the newest four-week interval.

Article content material

Commercial 4

Article content material

As the final word locations of cargoes loading in late January grew to become obvious, flows to China rose to new post-invasion highs, and remained near these ranges in February. Historic patterns counsel that many of the vessels presently recognized as “Unknown Asia” locations and heading for the Suez Canal will find yourself in India, whereas these loaded onto very giant crude carriers off the north coast of Morocco or, extra lately, within the Atlantic Ocean, will head to China.

Ship-to-ship transfers of cargoes within the Mediterranean proceed apace. This has been most seen off the Spanish north African metropolis of Ceuta and off the Greek coast close to Kalamata. At the very least 60 cargoes have been transferred between ships in these two areas because the begin of the 12 months.

Commercial 5

Article content material

Russia has additionally resumed cargo switch operations within the Atlantic Ocean, with the Aframax tanker Volans transferring its cargo into the VLCC Scorpius north of the Cape Verde islands over the weekend.

Crude Flows by Vacation spot

Crude flows within the week to April 14 rose by 540,000 barrels a day from the earlier week, to three.43 million barrels a day. On a four-week common foundation, total seaborne exports elevated by 50,000 barrels a day to three.39 million barrels a day.

Risky weekly information are affected by the scheduling of tankers and loading delays attributable to unhealthy climate. Port upkeep may disrupt exports for a number of days at a time.

All figures exclude cargoes recognized as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export by the Baltic ports of Ust-Luga and Novorossiysk.

Commercial 6

Article content material

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to differentiate them from these shipped by Russian corporations. Transit crude is particularly exempted from European Union sanctions.

4-week common shipments to Russia’s Asian prospects, plus these on vessels exhibiting no remaining vacation spot, edged larger, rising to inside 40,000 barrels a day of the all-time excessive set within the interval to March 31. Shipments rose to three.15 million barrels a day within the interval to April 14, in contrast with 3.1 million barrels a day beforehand.

Whereas the volumes heading to China and India seem to have declined, historical past exhibits that many of the cargoes on ships with out an preliminary vacation spot ultimately find yourself in a single or different of these nations.

Commercial 7

Article content material

The equal of 726,000 barrels a day was on vessels exhibiting locations as both Port Stated or Suez in Egypt, or which have already got been or are anticipated to be transferred from one ship to a different off the South Korean port of Yeosu. These voyages sometimes finish at ports in India or China and present up within the chart beneath as “Unknown Asia” till a remaining vacation spot turns into obvious.

The “Different Unknown” volumes, working at 396,000 barrels a day within the 4 weeks to April 14, are these on tankers exhibiting a vacation spot of Ceuta, Kalamata or no vacation spot in any respect. Most of these cargoes go on to transit the Suez Canal, however some may find yourself in Turkey. An rising quantity are being transferred from one vessel to a different within the Mediterranean for onward journeys to Asia.

Commercial 8

Article content material

Russia’s seaborne crude exports to European nations have been secure at 83,000 barrels a day within the 28 days to April 14, with Bulgaria the sole vacation spot. These figures don’t embody shipments to Turkey.

A market that consumed greater than 1.5 million barrels a day of short-haul crude, coming from export terminals within the Baltic, Black Sea and Arctic has been misplaced virtually fully, to get replaced by long-haul locations in Asia that are rather more pricey and time-consuming to serve.

No Russian crude was shipped to northern European nations within the 4 weeks to April 14.

Exports to Turkey, Russia’s solely remaining Mediterranean buyer, have been unchanged at 162,000 barrels a day within the 4 weeks to April 14.

Commercial 9

Article content material

Flows to Bulgaria, now Russia’s solely Black Sea marketplace for crude, remained secure at 83,000 barrels a day.

Flows by Export Location

Mixture flows of Russian crude rebounded from an eight-week low within the seven days to April 14, rising again above 3 million barrels a day. Decrease shipments from the Pacific have been greater than offset by will increase from all different areas.

Figures exclude volumes from Ust-Luga and Novorossiysk recognized as Kazakhstan’s KEBCO grade.

Export Income

Inflows to the Kremlin’s battle chest from its crude-export obligation rose by $7 million to $47 million within the seven days to April 14, whereas four-week common earnings edged larger to $46 million.

President Vladimir Putin has signed into regulation amendments to the best way Russia’s oil worth is assessed for tax functions. From April, charges of mineral extraction tax and profit-based tax on oil corporations are calculated utilizing a reducing low cost to prevailing Brent costs, somewhat than assessments of Urals crude. Export obligation, which can be phased out on the finish of 2023, just isn’t affected by the change.

Commercial 10

Article content material

The obligation fee for April was set at $1.95 a barrel, little modified from March, based mostly on a Urals worth of $50.80 a barrel in the course of the evaluation interval that ran from Feb. 15 to March 14. The speed for Could can be $1.96 a barrel, based mostly on a Urals worth of $51.15 a barrel between March 15 and April 14.

Origin-to-Location Flows

The next charts present the variety of ships leaving every export terminal and the locations of crude cargoes from the 4 export areas.

A complete of 31 tankers loaded 24 million barrels of Russian crude within the week to April 14, vessel-tracking information and port agent stories present. That’s up by 3.8 million barrels, or 19%, reversing lower than half of the earlier week’s hunch. Locations are based mostly on the place vessels sign they’re heading on the time of writing, and a few will virtually actually change as voyages progress. All figures exclude cargoes recognized as Kazakhstan’s KEBCO grade.

Commercial 11

Article content material

The overall quantity on ships loading Russian crude from Baltic terminals recovered to 1.56 million barrels a day.

Shipments from Novorossiysk within the Black Sea rose to a three-week excessive, with flows reaching 667,000 barrels a day.

Arctic shipments rebounded from the earlier week’s hunch, with two Suezmax and one Aframax tanker loading within the week to April 14.

Flows from the Pacific fell for a second week, with eight tankers loading on the area’s three export terminals within the week to April 14, down from 10 the earlier week.

Three cargoes of ESPO crude out of simply 5 loaded in the course of the week are on vessels heading to China. One vessel is heading to India and the opposite is exhibiting its vacation spot as Singapore. Earlier vessels heading there from Kozmino have ultimately gone on to India.

Commercial 12

Article content material

The remaining volumes heading to unknown locations are Sokol cargoes that lately have been transferred to different vessels at Yeosu, or are presently being shuttled to an space off the South Korean port from the loading terminal at De Kastri. Most of those are additionally ending up in India.

Notice: This story types a part of a daily weekly collection monitoring shipments of crude from Russian export terminals and the export obligation revenues earned from them by the Russian authorities.

Notice: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

—With help from Sherry Su.

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We’ve enabled electronic mail notifications—you’ll now obtain an electronic mail for those who obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra info and particulars on methods to regulate your email settings.

Be part of the Dialog