[ad_1]

The world’s largest oil producers kick off their earnings this week, with income forecast to gradual from final yr’s document highs as oil costs slumped within the first quarter. Elsewhere, the BNEF Summit will get underway in New York, whereas deal watchers will likely be targeted on a Teck Sources Ltd. shareholder vote on splitting up the corporate — with the end result dictating the way forward for Glencore Plc’s $23 billion takeover bid. Listed here are 5 notable charts to think about in world commodity markets because the week ge

![86z6hlhlghiso]b{gnsjrpu3_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/04/renewable-power-just-keeps-growing-global-wind-and-solar-ca.jpg?quality=90&strip=all&w=288&h=216&sig=vULh37ZZQS3I7Ac5tL0J-w)

Article content material

(Bloomberg) — The world’s largest oil producers kick off their earnings this week, with income forecast to gradual from final yr’s document highs as oil costs slumped within the first quarter. Elsewhere, the BNEF Summit will get underway in New York, whereas deal watchers will likely be targeted on a Teck Sources Ltd. shareholder vote on splitting up the corporate — with the end result dictating the way forward for Glencore Plc’s $23 billion takeover bid. Listed here are 5 notable charts to think about in world commodity markets because the week will get underway.

Commercial 2

Article content material

Article content material

Large Oil

Exxon Mobil Corp., Chevron Corp. and TotalEnergies SE all report earnings this week, adopted by Shell Plc and BP Plc in early Might. Regardless that all 5 posted blowout income in 2022, adjusted internet earnings is ready to chill within the first quarter because of softening oil and gasoline costs. Mixed, the largest western oil corporations are forecast to have made $36.5 billion, in keeping with information compiled by Bloomberg. Whereas that’s down greater than 40% from the height within the second quarter of 2022, it could nonetheless mark the seventh-highest stage recorded because the mega-mergers of the 2000s created the businesses of their present type.

Jet Gasoline

Regulate China air journey. After punishing Covid restrictions, the nation is returning to the skies and the tempo is predicted to speed up heading into the Golden Week vacation subsequent month. Jet gasoline demand reached almost 75% of its pre-pandemic ranges within the week ended April 15, in keeping with JPMorgan Chase & Co., whereas worldwide flights to and from the nation proceed to climb. The probability of elevated air journey within the coming weeks explains why jet gasoline consumption in China is broadly seen as the one greatest driver of world oil demand progress this yr, analysts from the financial institution stated. In the meantime, gasoline consumption in the remainder of the world can also be choosing up, BloombergNEF information present.

Article content material

Commercial 3

Article content material

Transport

Sticking with China, let’s check out its ports the place container packing containers of imported items are stacking up regardless of improved financial information. Whereas the economic system grew on the quickest tempo in a yr within the first quarter, ports just like the world’s largest in Shanghai are dealing with extra incoming packing containers than exports, in keeping with information from Container xChange. That’s due to a hunch in demand from main export locations such because the US and Europe, the place financial uncertainty continues to be weighing on client urge for food. In Shanghai, inbound containers are constantly making up about 64% of the entire variety of containers on the port. That’s a far cry from January 2021, when exports accounted for the majority of exercise. The backlog of imports, coupled with empty container packing containers not used to hold Chinese language exports again throughout the ocean, might discover themselves caught till world consumption accelerates.

Commercial 4

Article content material

Mining M&A

Glencore is racing to persuade Teck traders forward of a Wednesday vote to reject the corporate’s plans to separate its metals and coal companies, a prerequisite for the Swiss commodities large’s $23 billion takeover bid to maneuver ahead. If Glencore prevails and might persuade Teck shareholders to just accept the proposal on its present phrases, the deal would rank within the high 10 greatest amongst metals producers ever. At Friday’s shut, Teck’s B shares have been buying and selling under the worth of Glencore’s provide, implying the market isn’t satisfied the proposed takeover will occur.

Renewable Power

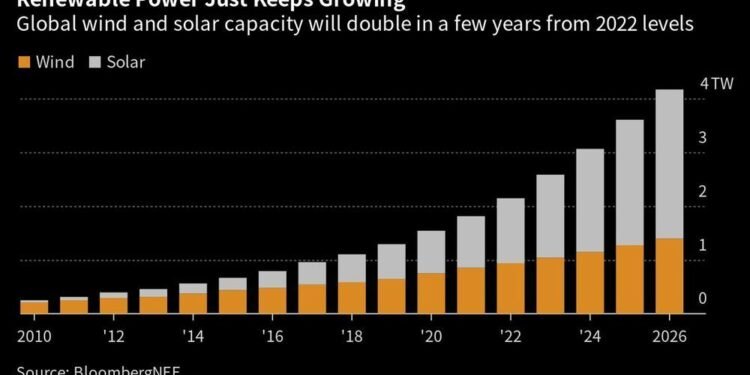

Executives from main utilities, oil producers and pure gasoline corporations will convene at a BloombergNEF summit in New York beginning Monday because the world navigates the transition to internet zero. Adoption of renewable energy is ready to proceed increasing, with world wind and photo voltaic capability seen roughly doubling by 2026 from present ranges to nearly 4.2 terawatts, in keeping with BNEF information. Within the US, the 2 sources are anticipated to be the spine of energy provide by 2050, because of beneficiant funding supplied by the landmark Inflation Discount Act. Different matters of dialogue on the two-day occasion embody safeguarding critical-mineral provide chains, vitality storage, battery expertise and clean-energy finance.

—With help from Kevin Crowley, Ann Koh, Claudio Lubis, Chunzi Xu, William Mathis, Simon Casey and Brad Skillman.

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We’ve enabled electronic mail notifications—you’ll now obtain an electronic mail for those who obtain a reply to your remark, there may be an replace to a remark thread you observe or if a person you observe feedback. Go to our Community Guidelines for extra data and particulars on modify your email settings.

Be a part of the Dialog