[ad_1]

The Federal Reserve and European Central Financial institution solid forward with interest-rate hikes this week, although Washington policymakers signaled they’re within the closing spherical of their inflation combat.

![j]1knjl{ofntwf]aeb6vyltd_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/05/copper-mines-are-taking-longer-the-average-length-of-time-t.jpg?quality=90&strip=all&w=288&h=216&sig=xr8zXPGbWGl3UxswV7TZjw)

Article content material

(Bloomberg) — The Federal Reserve and European Central Financial institution solid forward with interest-rate hikes this week, although Washington policymakers signaled they’re within the closing spherical of their inflation combat.

Commercial 2

Article content material

The story of the tape: ECB President Christine Lagarde acknowledged there may be “extra floor to cowl” and the central financial institution isn’t pausing due to “important” inflation. Fed Chair Jerome Powell hinted officers might have room to face pat and assess the impression of their coverage tightening towards a backdrop of stress within the banking system.

Article content material

Listed below are among the charts that appeared on Bloomberg this week on the newest developments within the international financial system:

World

Apart from hikes by the Fed and ECB, Australia signaled additional coverage tightening forward after unexpectedly elevating rates of interest. Norway’s central financial institution lifted borrowing prices to the very best stage since 2008 and signaled extra to return. The Czech central financial institution stored its benchmark price at 7%, Malaysia unexpectedly boosted its price and Brazil held charges regular, resisting calls from the federal government for looser coverage.

Article content material

Commercial 3

Article content material

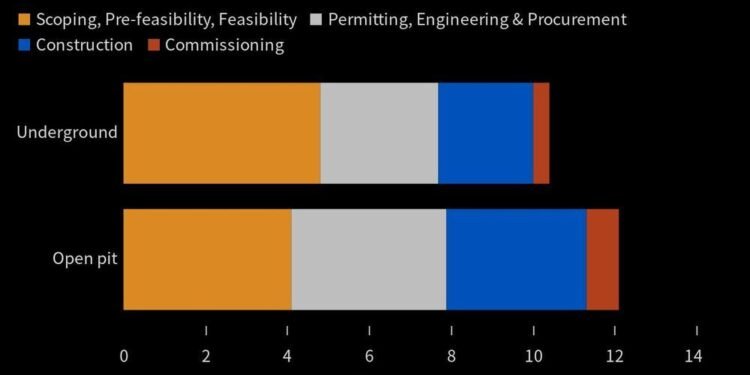

Oyu Tolgoi, in southern Mongolia simply north of the Chinese language border, is essential to Rio Tinto Group’s efforts to increase in copper, the steel that underpins the clear vitality transition. However analysts at Wooden Mackenzie estimate a greener world can be quick about six million tons of copper by subsequent decade, that means 12 new Oyu Tolgois want to return on-line inside that interval. BloombergNEF estimates urge for food for refined copper will develop by 53% by 2040, however mine provide will climb solely 16%.

US

Powell hinted the Fed’s newest interest-rate improve might be the final one, however stopped in need of declaring victory on its battle towards fast value will increase. The Fed chief mentioned there was robust assist for elevating charges by 25 foundation factors. However he instructed officers might pause their tightening marketing campaign in June to evaluate how the financial system is responding to tighter credit score situations and up to date stress within the banking sector.

Commercial 4

Article content material

Anybody in search of indicators of an imminent downturn for the US financial system gained’t discover it within the newest employment information. That’s the takeaway from the newest month-to-month jobs numbers, which confirmed an acceleration in hiring and pay positive factors final month as working-age People continued streaming again into the labor market.

Washington’s potential to avert a catastrophic US debt default dangers coming all the way down to as few as seven days in Might, underscoring the big menace of the continued partisan deadlock. Time is brief and it’s unlikely the 2 events will strike a grand discount earlier than the potential X-date suggested by Treasury Secretary Janet Yellen — elevating the chance of a short-term repair.

American shoppers are nonetheless desperate to spend, giving firms that cater to them room to push via extra value will increase. That’s a key takeaway halfway via earnings season. Firms within the client staples section, which incorporates such family names as Coca-Cola, Procter & Gamble and Hershey, stood out, with 90.5% reporting first-quarter outcomes via Might 2 that beat analyst expectations, versus 80% for your complete S&P 500.

Commercial 5

Article content material

Europe

The ECB delivered the smallest interest-rate improve but in its battle with persistently robust inflation however insisted that the transfer gained’t be the final. Officers raised the deposit price by a quarter-point to three.25%, the very best since 2008. In what could also be seen as a concession to hawkish officers, to win their backing for the smaller price improve, the ECB additionally mentioned it expects to halt reinvestments below its Asset Buy Program as of July.

Britain’s financial system is exhibiting indicators of surprising resilience, firming up the case for one more interest-rate improve. Figures on inflation expectations additionally indicated corporations anticipate a good sharper rise in their very own costs over the following yr.

Britain’s acute housing scarcity, snarled planning departments and native protectionism are combining to divide a nation the place homeownership was as soon as seen as a ceremony of passage. However past the thorny points is a quieter actuality: a decade of price range cuts have left native governments with too few folks to maintain up with approving new properties.

Commercial 6

Article content material

Asia

China’s financial restoration stays patchy, with newest indicators pointing to a contraction in manufacturing, whereas shoppers splurge over the vacations and the housing market continues to rebound. Buying managers’ indexes confirmed an surprising decline in manufacturing unit exercise in April, weighed down by weaker international demand for Chinese language exports.

Rising Markets

The Worldwide Financial Fund expects Saudi Arabia gained’t steadiness its price range if oil is under $80 a barrel, a revision which means the dominion will transfer again into fiscal deficit after its first surplus in nearly a decade.

—With help from Abeer Abu Omar, Matthew Boesler, Enda Curran, Steven T. Dennis, James Fernyhough, John Liu, Yujing Liu, Jonnelle Marte, Reade Pickert, Jana Randow, Tom Rees, Zoe Schneeweiss, Damian Shepherd and Alexander Weber.

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail if you happen to obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Community Guidelines for extra info and particulars on easy methods to regulate your email settings.

Be a part of the Dialog