[ad_1]

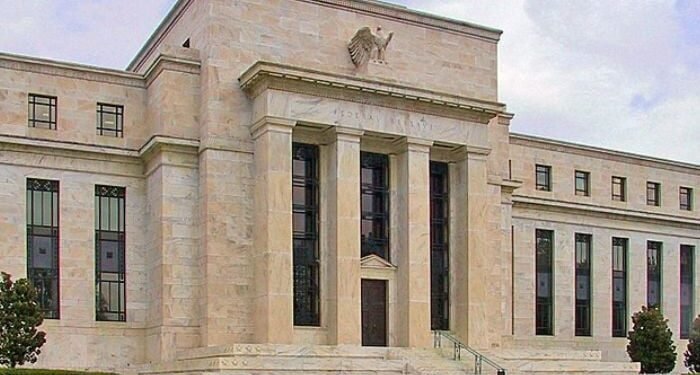

As readers are already conscious, there’s all the time a number of hypothesis and panting by the deep-in-thought forward of rate of interest choices by the Federal Reserve. However relatively than fill many books with simply how absurd the notion of central credit score planning is, how about we simply scale back it to the absurd: what if the Fed had raised the funds fee to 36% final week?

Wouldn’t it imply something? No, not likely. Give it some thought.

Does anybody critically assume Jeff Bezos must pay 36% as a way to borrow on the Fed’s artificially arrived at fee of curiosity? Hopefully the query solutions itself, but when not the apparent actuality is that Bezos wouldn’t even pay wherever shut to the current 5% fee that the Fed arrived at. Billionaires borrow way more cheaply than you and me.

RELATED: Federal Reserve Chairman Makes Startling Admission About Economic Recession

Contemplating the above as soon as once more by means of the absurdist prism, the overwhelming majority of Individuals wouldn’t pay wherever near 36% to borrow. That’s true firstly as a result of banks by advantage of being banks can’t take dangers remotely resembling a mortgage that will fee a 36% fee of curiosity.

That’s is so as a result of loans made by banks should carry out, and a 36% fee of curiosity is a market sign suggesting excessive odds that the mortgage received’t be repaid. A excessive fee of curiosity is what a lender calls for in “hire” in return for the likelihood that the borrower might be delinquent on the hire. Banks but once more don’t take such dangers.

Simply as banks received’t lend at nosebleed ranges if the Fed decrees such, neither will lenders typically. An artificially excessive worth management is merely an indication that markets would and can communicate, just for voluminous lending from these with title to cash at charges nicely beneath the artificially excessive one.

On the similar time, 36% is a fee of curiosity that’s plainly too low for debtors with restricted means. Let’s name them “subprime debtors.” Economists J. Brandon Bolen, Gregory Elliehausen, and Thomas Miller carried out an in depth research of synthetic charges of curiosity within the aftermath of the 2021 passage of the Predatory Mortgage Prevention Act in Illinois. The latter put a 36% ceiling on what non-bank monetary establishments might cost subprime debtors.

What Bolen et al found was what financial idea has lengthy supported: the imposition of an artificially low fee of curiosity would lead to lowered lending. That’s actually what occurred to subprime debtors in Illinois. Some have been even too dangerous at 36%. Markets all the time have their say, they usually do with out regard to what central bankers would possibly decree.

RELATED: ‘Crisis:’ Small Businesses Getting Crushed Under Inflation, Labor Market

It’s all a reminder that the Federal Reserve engages in worth controls with out costs truly being managed. When the central financial institution is at zero, there’s no lending at zero just because credit score is rarely costless. And it’s not costless as a result of essentially the most highly effective funding drive on the earth is compound curiosity. The ability of the earlier fact tells us that whereas the Fed can function in a parallel universe, there’ll all the time be a really actual (and generally substantial) value to accessing the products, companies and human capital that cash could be exchanged for.

Help Conservative Voices!

Signal as much as obtain the newest political information, perception, and commentary delivered on to your inbox.

Simply the identical, artificially excessive charges of curiosity will equally give off unreal connotations. Compound curiosity’s genius but once more requires that wealth be put to work, which suggests a Fed at 36% would reside in a parallel universe relatively resemblant of central banks at zero.

John Tamny is editor of RealClearMarkets, Vice President at FreedomWorks, a senior fellow on the Market Institute, and a senior financial adviser to Utilized Finance Advisors (www.appliedfinance.com). His newest e book is The Money Confusion: How Illiteracy About Currencies and Inflation Sets the Stage For the Crypto Revolution.

The opinions expressed by contributors and/or content material companions are their very own and don’t essentially replicate the views of The Political Insider.

[ad_2]

Source link