[ad_1]

The dangers for bond traders from subsequent week’s Federal Reserve assembly go nicely past whether or not officers determine to lift rates of interest once more.

Article content material

(Bloomberg) — The dangers for bond traders from subsequent week’s Federal Reserve assembly go nicely past whether or not officers determine to lift rates of interest once more.

Commercial 2

Article content material

For a market that’s been betting that the central financial institution will pivot to chopping charges pretty quickly, its up to date quarterly forecasts for the coverage price and key financial indicators — set to be launched Wednesday concurrently the speed determination — will probably be at the very least as necessary.

Article content material

The speed determination is crucial in fact, particularly as merchants stay break up over whether or not a rise is likelier in June or July. However there’s extra driving on the course of coverage after that time.

The Fed’s been adamant that it’s untimely to consider price cuts this 12 months, and merchants now not count on a couple of. Nonetheless, there are many bets in choices and elsewhere that an financial slowdown would require decrease borrowing prices.

So the financial projections of the Federal Open Market Committee members and Chair Jerome Powell’s tone throughout his post-decision press convention might form the response greater than the timing of the following quarter-point hike. In the event that they counsel that circumstances are peaking, wagers on a pivot would improve, whereas a extra strong and hawkish set of predictions would spur bets on higher-for-longer charges.

Article content material

Commercial 3

Article content material

“The market is positioned for a rally in lengthy length,” mentioned Meghan Swiber, charges strategist at Financial institution of America Corp., referring to the a part of the market that advantages most from declining yields, “and the final word factor that underpins that view is that the Fed is finished with the climbing cycle.”

Asset managers favoring long-maturity Treasuries or positioning for a steeper yield curve are anticipating the tip of Fed price will increase, Swiber mentioned. Financial institution of America’s newest month-to-month survey of investor sentiment discovered that publicity to US greenback length is at its highest degree since 2004, having eclipsed the pandemic highs of April 2020.

Swap contracts linked to future Fed conferences — which on the finish of Could virtually totally priced in a quarter-point improve in June — have downgraded that end result to about one in three — nonetheless an uncommon lack of consensus so quickly earlier than the occasion. The Fed has raised charges 10 consecutive instances since March 2022, and in all however two instances swaps pricing mirrored little doubt concerning the probably end result.

Commercial 4

Article content material

The July contract’s price at about 5.31% is about 23 foundation factors larger than the 5.08% degree of the speed focusing on by the Fed, practically totally pricing in a 25-basis-point improve by then. For December, the contract price is 5.07%, anticipating that any quarter-point price improve from the present degree will probably be reversed by year-end.

“The Fed is just about achieved even when they go one or two extra instances,” mentioned Arvind Narayanan, senior portfolio supervisor at Vanguard Group Inc. “Both the financial system slows materially right into a recession that forces the Fed to chop charges, or the financial system slows down sufficient to maintain charges at 5% for the remainder of 12 months after which the Fed slowly eases subsequent 12 months.”

What Bloomberg’s strategists say

“It’s uncommon certainly for the Fed to re-tighten coverage after pausing. It’s even rarer for it to take action when charges are already restrictive.”

Commercial 5

Article content material

— Simon White, macro strategist

For the complete column, click on right here

Inflation knowledge to be launched early Tuesday might show decisive. The expansion price for the patron worth index is forecast to gradual to 4.1% in Could from 4.9%, and to five.2% from 5.5% excluding meals and power. The Fed seeks an inflation price averaging 2% over time.

Citigroup Inc. economists, who count on a June price improve, pin that forecast on Could CPI readings they predict will present underlying inflation stays nearer to five%, Andrew Hollenhorst, chief US economist on the financial institution, mentioned in a video launched Thursday.

Forward of the assembly, indicators from the Treasury market could also be distorted by an unusually great amount of latest provide compressed into two days. Along with the month-to-month gross sales of 3- and 10-year observe and 30-year bonds, usually unfold over three days, $206 billion of Treasury payments are slated to be offered to replenish the federal government’s coffers, which had been depleted till the federal debt restrict was suspended final week.

Commercial 6

Article content material

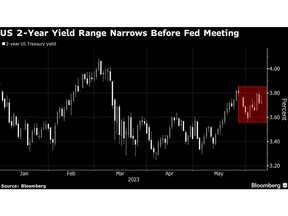

Expectations for extra Fed price will increase peaked this 12 months in early March, when Powell mentioned policymakers had been ready to re-accelerate the tempo of price will increase if warranted by financial knowledge. The 2-year Treasury observe’s yield, extra delicate than longer maturities to adjustments within the Fed’s price, briefly topped 5%. It’s stabilized round 4.6% because the case for extra price hikes has been dented by a number of regional financial institution failures and different indicators that the financial system might lastly be reckoning with tighter monetary circumstances.

“We predict it’s extra probably the Fed will skip into July,” mentioned Thomas McLoughlin, head of fastened earnings for the Americas within the chief funding workplace at UBS Group’s wealth-management arm. “However Powell’s message has been that his intent is to maintain a decent financial coverage at the very least by means of the tip of the 12 months and doubtlessly into subsequent 12 months.”

Commercial 7

Article content material

What to Watch

- Financial knowledge calendar

- June 12: Month-to-month price range assertion

- June 13: Client worth index; NFIB small enterprise optimism

- June 14: MBA mortgage purposes; producer worth index

- June 15: Retail gross sales; jobless claims; import and export worth indexes; Empire manufacturing; Philadelphia Fed enterprise outlook; industrial manufacturing; enterprise inventories; Treasury worldwide capital flows

- June 16: New York Fed providers enterprise exercise; U. of Michigan sentiment and inflation expectations

- Federal Reserve calendar

- June 14: FOMC coverage determination; abstract of financial projections; Chair Jerome Powell press convention

- Public sale calendar

- June 12: 26- and 13-week payments; 3- and 10-year notes

- June 13: 52-week payments; 42-day money administration payments; 30-year bonds

- June 14: 17-week payments

- June 15: 4- and 8-week payments

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We now have enabled e-mail notifications—you’ll now obtain an e-mail for those who obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra data and particulars on learn how to regulate your email settings.

Be part of the Dialog