[ad_1]

Don’t belittle Company America’s well-known revenue engine.

![6{)5e0hb]v9v93aup6vpu8mb_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/07/earnings-revision-momentum-signals-brighter-times-ahead-pro.jpg?quality=90&strip=all&w=288&h=216&sig=TjjZnCEn9dPB5Cb1sdlRQg)

Article content material

(Bloomberg) — Don’t belittle Company America’s well-known revenue engine.

Commercial 2

Article content material

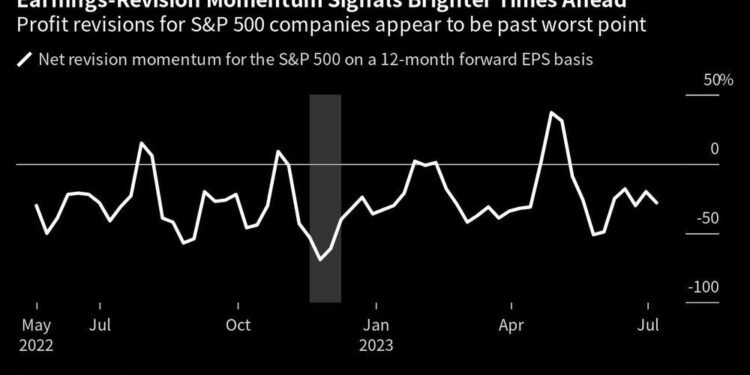

Fairness strategists are boosting earnings forecasts for the S&P 500 Index over the approaching 12 months sooner than they’re marking them down, pushing a key indicator monitoring the momentum of analyst revisions nicely off its November nadir. After hitting unfavourable 70% late final 12 months, this metric — which focuses on ahead earnings-per-share over 12 months — is nearer to optimistic territory at minus 28%, in line with information compiled by Bloomberg Intelligence.

Article content material

The indicator has been touted as a forward-looking gauge on the revenue outlook which will assist the case for inventory good points over the approaching 12 months. The trough in revisions is a tell-tale signal that the earnings story is selecting up, per Michael Casper, fairness strategist at BI. Actually, the S&P 500 traditionally has seen a median improve of 5.1% within the 4 quarters following a trough in earnings-per-share progress, BI information present.

Article content material

Commercial 3

Article content material

Learn extra: JPMorgan’s Finest Quarter Ever Reveals Large Banks in Price Candy Spot

“That is excellent news for the outlook on company earnings and the trajectory of the inventory market as a result of this indicator has most certainly lastly bottomed,” Casper mentioned. “It means extra shares are starting to see higher occasions forward — and an eventual optimistic studying will affirm that the outlook is certainly rosier for 2024.”

So regardless that earnings for S&P 500 companies are forecast to drop for a 3rd straight quarter, earnings progress is definitely enhancing when the vitality sector is excluded. The group has skewed estimates decrease for the broader index as inflation and commodity costs ebb, with earnings progress with out the sector anticipated to return within the second half of the 12 months, BI information present.

Commercial 4

Article content material

It’s the most recent seemingly inconceivable twist for the nice danger rally of 2023 that’s defying Wall Avenue worrywarts fretting every part from a recession to aggressive Federal Reserve hikes.

Whereas 9 of the 11 sectors within the benchmark gauge see unfavourable revisions for earnings over the following 12 months, two key teams recognized for his or her cyclical monicker — industrials and discretionary — have turned optimistic, whereas expertise is on the precipice of additionally reaching that encouraging threshold.

That’s a pivotal improvement since industrials and discretionary, that are tied to the well being of the US financial system, have been among the many first sectors to steer a slowdown in earnings progress final 12 months. This time round, they’re driving the restoration in revenue outlooks since most of the companies housed within the two industries are financial reopening performs following the pandemic. After all, vitality faces probably the most ache as inflation has ebbed, with crude costs subsequently falling.

Commercial 5

Article content material

With that mentioned, there stays loads of concern that the inventory market could possibly be dragged down additional by an financial slowdown or recession that might lower extra deeply into earnings, significantly on lingering issues {that a} still-hawkish Fed will derail the rally. That’s set off alarm bells for some following this 12 months’s large rally in Large Tech, leaving inventory multiples wealthy and market focus sitting at extremes.

“The large danger is valuations stay too excessive,” cautioned Brian Frank, portfolio supervisor of the Frank Worth Fund. “If there’s a big decline in general earnings progress for the S&P 500, there can be loads of potential draw back for the broader inventory market.”

Wall Avenue analysts mission that S&P 500 firms will see the largest contraction in earnings progress through the second quarter, the place earnings are anticipated to fall by 9% year-over-year. With simply over 5% of firms within the index having reported, revenue progress for the interval is on observe to have contracted by 9.3% to date.

Commercial 6

Article content material

Nonetheless, to Dan Eye, chief funding officer at Fort Pitt Capital Group, the momentum from upward revisions to earnings estimates might begin to surpass the Fed’s interest-rate coverage as the first driver of the inventory market within the coming months.

Why? Effectively, different optimistic indicators counsel that broad revenue progress will return within the second half of the 12 months, significantly as producer-price inflation continues to enhance — a decisive second that’s promising to bolster margins, which is poised to assist usher in a better-than-feared revenue outlook for the second quarter.

“The worst of the revenue ache is probably going over, until there’s a state of affairs the place there’s a deep recession — which we don’t see since inflation has considerably eased,” Eye added. “It’s fairly apparent that the inventory market began sniffing out brighter occasions forward for earnings awhile in the past, as clearly mirrored on this 12 months’s fairness rebound.”

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail for those who obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra info and particulars on regulate your email settings.

Be part of the Dialog