[ad_1]

Article content material

(Bloomberg) — Australian enterprise situations confirmed ongoing resilience to greater rates of interest, defying expectations of a pointy financial slowdown, at the same time as shopper sentiment stays “deeply pessimistic.”

Enterprise situations, which measure gross sales, employment and profitability, eased a tad to 10 factors in July whereas holding above the common for the reason that begin of the yr, a Nationwide Australia Financial institution Ltd. survey confirmed Tuesday. Confidence superior to 2 factors, implying optimists outnumber pessimists.

Article content material

The information problem “expectations that the financial system would proceed to chill as 2023 wears on,” NAB stated. “Labor value progress rose sharply” as did buy prices, reflecting sturdy vitality costs and highlighting appreciable upside pressures to third-quarter inflation, it stated.

Separate figures from Westpac Banking Corp. launched an hour earlier, confirmed shopper sentiment slipped 0.4% to 81 factors, that means pessimists closely outnumber optimists, with a studying of 100 the dividing line. The index has held in a 78-86 vary over the previous yr.

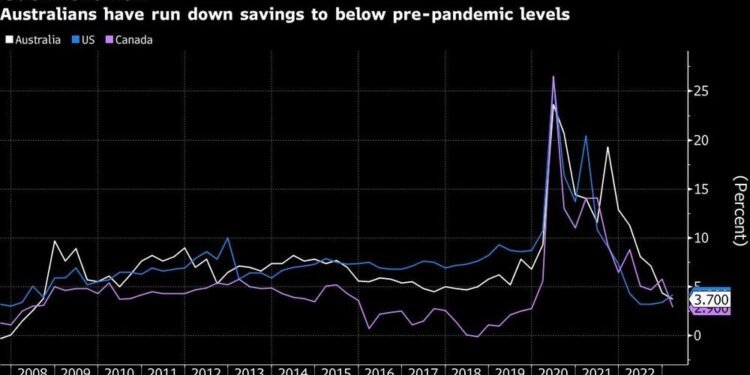

The surveys present an ongoing divergence between family and company sentiment, suggesting companies are higher ready to deal with surging borrowing prices. The Reserve Financial institution has raised charges by 4 share factors since Could final yr because it battles to comprise inflation that’s nonetheless working at 6%.

NAB’s report confirmed main indicators strengthened barely with ahead orders edging up and capability utilization climbing to 84.5%. The outcomes got here at the same time as labor value progress rose 3.7% in quarterly equal phrases, up from 2.3% within the three months by way of June. Remaining worth progress, which incorporates buy prices, doubled to 2%, from 1% within the second quarter.

Article content material

Households are struggling amid “continued pressures on household funds and considerations in regards to the rate of interest and financial outlook,” Westpac Senior Economist Matthew Hassan stated.

The patron survey was carried out July 31-Aug. 4, spanning the RBA’s Aug. 1 assembly when it left the money fee unchanged at 4.1% for a second straight month. The outcomes “pointed to little or no influence from the RBA’s determination to pause,” Hassan stated.

Assessments of “household funds in comparison with a yr in the past” rose 3.4% to 64.3, remaining at an “extraordinarily weak degree total,” Hassan stated. The “household funds subsequent 12 months” sub-index edged 0.2% greater to 89.9.

A gauge of the outlook for family spending, “the time to purchase a serious family merchandise” sub-index inched up 0.3%, once more holding at traditionally low ranges at 79 factors, the report confirmed.

Hassan expects the RBA will now be on an prolonged pause, holding the money fee unchanged at 4.1%.

“Shoppers might not be satisfied however we’ve got very doubtless reached the height within the rate of interest tightening cycle,” he stated.

(Provides particulars from NAB enterprise survey.)

[ad_2]

Source link