[ad_1]

China’s financial system is displaying little signal of a rebound, with recent stress within the property market and deflation threatening the expansion outlook.

Article content

(Bloomberg) — China’s economy is showing little sign of a rebound, with fresh stress in the property market and deflation threatening the growth outlook.

Official data on Tuesday will likely show modest gains in industrial output, retail sales and fixed-assets investment in July from a year ago, although growth rates are still well below pre-pandemic levels.

Advertisement 2

Article content material

Article content material

Actual property funding in all probability shrank additional, with confidence shaken by a potential default by a serious developer and housing gross sales persevering with to fall as properly.

Including to the gloom, heavy rain and lethal floods final month within the southwest and extra lately within the north of China probably hindered building and infrastructure tasks, curbing financial exercise.

The numbers observe financial information up to now week that confirmed deflation arriving in July as producers and retailers minimize costs in a bid to lure consumers and transfer extra inventory. Exports and imports additionally plunged greater than anticipated, whereas borrowing by shoppers and companies slumped.

Beijing has made a number of pledges and introduced incremental measures to assist development, however has prevented the form of financial and financial stimulus applied throughout earlier downturns. A weaker yuan and excessive debt ranges have prompted extra warning.

The federal government additionally set a reasonably conservative development goal of about 5% for the yr, which stays on monitor even with out main stimulus. The Individuals’s Financial institution of China is more likely to maintain a key coverage rate of interest unchanged at 2.65% on Tuesday, in response to economists surveyed by Bloomberg.

Article content material

Commercial 3

Article content material

What Bloomberg Economics Says:

“The financial system wants extra assist. We see the central financial institution delivering it within the third quarter by releasing up extra cash for banks to lend and trimming borrowing prices additional.”

—For full evaluation, click on right here

Elsewhere, US knowledge might present resilient shopper demand, UK wage and inflation numbers will information buyers betting on future Financial institution of England fee hikes, and Japanese development statistics can even be launched.

Click on right here for what occurred final week, and beneath is our wrap of what’s arising within the international financial system.

US and Canada

Following studies up to now week displaying inflation is moderating, recent snapshots of retail demand, house building and manufacturing unit output will set the tone for the financial system in the beginning of the third quarter.

As well as, the Federal Reserve on Wednesday will serve up minutes of its July coverage assembly, at which officers boosted charges 1 / 4 of a proportion level to a 22-year excessive. Traders will gauge the account for clues on the urge for food for additional hikes, although odds favor a pause in September.

On Tuesday, a report is forecast to point out retail gross sales picked up in July. Resilience in shopper demand, augmented by a still-healthy labor market, would underscore views that the financial system has scope to keep away from a recession.

Commercial 4

Article content material

The next day, separate knowledge might present a rise in July new-home building as builders reply to lean inventories within the resale market. A rise in begins of single-family houses could be the fifth within the final six months.

Whereas housing is displaying indicators of stabilizing, manufacturing is struggling for momentum. A Fed report is projected to point out manufacturing unit manufacturing little modified final month after two months of declines.

Turning north, Statistics Canada will launch inflation knowledge for July, after the patron value index slowed to 2.8% in June. That was the primary time in two years that it fell inside the Financial institution of Canada’s management vary.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

Asia

Away from China, Indian knowledge on Monday will reveal if inflation accelerated in July.

Japanese numbers on Tuesday are anticipated to point out the financial enlargement continued within the second quarter, whereas value knowledge Friday are forecast to point out inflation remained properly above the Financial institution of Japan’s goal in July.

Additionally on Tuesday, the Reserve Financial institution of Australia will launch minutes from its August assembly, the place it held charges regular, forward of recent labor statistics on Thursday which will present employment development slowing.

Commercial 5

Article content material

In neighboring New Zealand, which simply noticed its first month-to-month drop in meals costs since early 2022, the central financial institution is predicted to carry charges regular on Wednesday, whereas its counterpart within the Philippines is forecast to face pat on Thursday.

Malaysia unveils second-quarter gross home product statistics on Friday.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

After information of the UK financial system’s resilience within the second quarter, recent knowledge will assist decide the Financial institution of England’s resolve in enacting additional fee hikes, with the primary of two months of key studies due earlier than the Sept. 20 resolution.

Wage numbers on Tuesday will present the extent that increased costs are feeding by way of into self-reinforcing pay pressures. Then, July inflation knowledge on Wednesday are more likely to reveal a big slowdown, although an underlying gauge stripping out power and different unstable components is seen barely budging.

Within the euro zone, the week shall be interrupted in lots of international locations – together with France and Italy – by holidays on Tuesday.

Except for German investor confidence that day, merchants might give attention to doubtlessly revised readings of euro-area GDP and inflation, on Wednesday and Friday respectively, which can present whether or not latest knowledge — for instance, Germany’s industrial manufacturing drop — recast the general image for the financial system.

Commercial 6

Article content material

Within the Nordics, Sweden’s consumer-price report on Tuesday will draw consideration, at a time when the Riksbank stays dedicated to tightening at the same time as proof of its influence on the financial system turns into more and more clear.

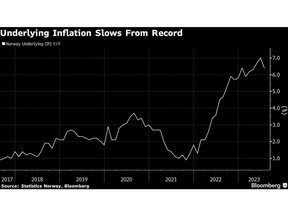

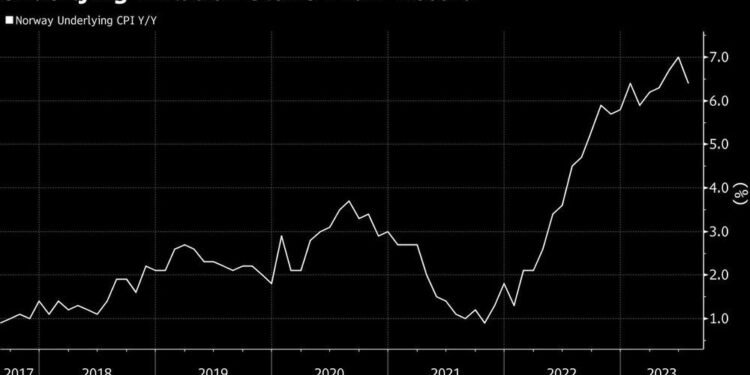

On Thursday, Norges Financial institution might ship a quarter-point fee hike flagged at its final resolution, after slowing core consumer-price development eased stress on policymakers to go for an even bigger transfer.

Turning south, buyers on Tuesday will discover out if inflation in Israel decelerated for a 3rd month in July. That might make the Financial institution of Israel — which lately stated it may not be completed with fee mountain climbing — much less inclined to additional tighten coverage.

The identical day, Nigerian knowledge will probably present inflation surged past June’s 22.8% stage, stoked by the removing of gasoline subsidies and the devaluation of the naira.

In Uganda, financial officers are anticipated to face pat for a fifth assembly after the inflation fee fell beneath the central financial institution’s 5% goal up to now two months. Two days later, on Thursday, Rwanda can also be more likely to maintain charges on maintain.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Commercial 7

Article content material

Latin America

Manufacturing, industrial output and retail gross sales knowledge for June printed this week ought to underscore a dramatic slowdown in Colombia’s financial system

Quarter-on-quarter output probably declined for the primary time since 2021 within the three months by way of June, whereas the year-on-year end result and June’s GDP-proxy studying stalled.

Chile’s central financial institution, led by chief Rosanna Costa, turned heads by kicking off its easing cycle with a bigger-than-expected 100 basis-point fee minimize final month, so the minutes of that assembly, due on Monday, shall be a must-read for Chile watchers.

Banco Central de Chile can even submit its survey of merchants together with its second-quarter output report, which is extensively anticipated to point out a gentle contraction as first-half mining exercise dissatisfied.

Information posted in Peru this week might present that unemployment in Lima declined for a fourth month in July.

GDP-proxy knowledge are more likely to present output fell in June, Finance Minister Alex Contreras stated this month, which might imply the financial system posted consecutive quarter-on-quarter contractions within the first half of 2023.

In Argentina, the July shopper value report will probably present an 18th straight year-on-year rise from June’s 115.6% studying.

The central financial institution, which raised its key fee to 97% in Could, usually follows up on inflation knowledge with financial coverage bulletins.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Nasreen Seria, Vince Golle, Paul Jackson, Monique Vanek, Paul Wallace and Robert Jameson.

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. Now we have enabled e-mail notifications—you’ll now obtain an e-mail in case you obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Community Guidelines for extra data and particulars on easy methods to alter your email settings.

Be a part of the Dialog