[ad_1]

Article content material

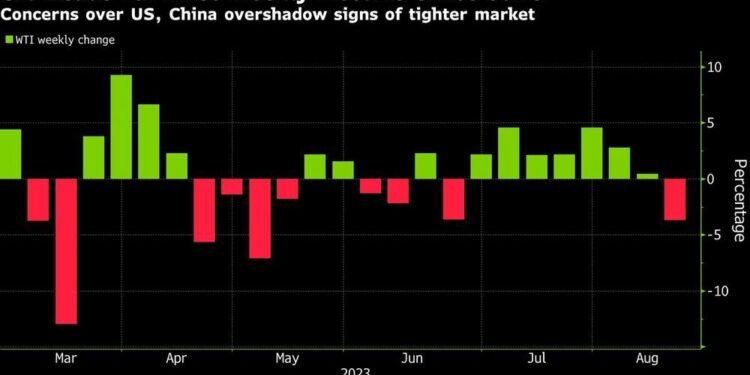

(Bloomberg) — Oil headed for its first weekly loss since June as issues over financial weak spot in China and doubtlessly even tighter financial coverage within the US mixed to overshadow indicators of a tighter bodily market.

West Texas Intermediate traded above $80 a barrel, set for a drop of about 3% this week as a stream of poor financial knowledge from China has weighed on danger belongings together with oil. That has eclipsed indicators of a tighter crude market, with US stockpiles declining to the bottom stage since January.

Article content material

Within the US, Federal Reserve policymakers have signaled they will not be accomplished mountain climbing charges to tame inflation, serving to to elevate Treasury yields and aiding the greenback. The US forex is on the right track for a fifth weekly acquire, the longest run in additional than a 12 months, which dulls the attract of commodities for abroad patrons.

Crude stays markedly larger from its lows in June, pushed largely by provide cuts by OPEC+ linchpins Saudi Arabia and Russia. That’s led many observers, together with the Worldwide Vitality Company, to forecast tighter balances and better costs earlier than the 12 months is out. Nonetheless, Citigroup Inc. has countered that oil will weaken as consumption disappoints and provide swells.

Commodities together with oil are “licking their wounds from a conspiracy of upper yields, stronger US greenback, and risk-off” sentiment, mentioned Vishnu Varathan, Asia head of economics and technique at Mizuho Financial institution Ltd. China’s underwhelming knowledge is “chilly consolation for commodities,” he mentioned.

Nonetheless, timespreads proceed to sign underlying power whilst futures have softened. The front-month unfold for WTI was 61 cents a barrel in a bullish, backwardated construction, little modified over the week, and up from 9 cents a barrel in backwardation a month in the past.

To get Bloomberg’s Vitality Every day e-newsletter direct into your inbox, click on right here.

[ad_2]

Source link