[ad_1]

The one commodity that needs to be getting hammered by China’s worsening property disaster is definitely doing slightly effectively.

![5]pvvvpk0w}548d]9ym{84ct_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/08/iron-ore-has-managed-to-stay-above-100-for-most-of-2023.jpg?quality=90&strip=all&w=288&h=216&sig=gAtaGEz1jZFVO3bFHXBj9Q)

Article content material

(Bloomberg) — The one commodity that needs to be getting hammered by China’s worsening property disaster is definitely doing slightly effectively.

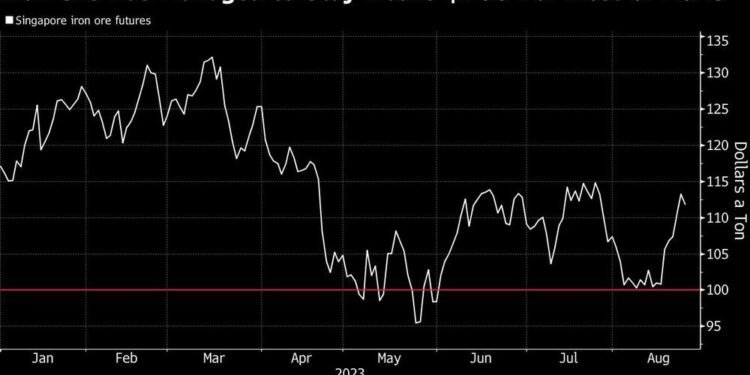

Iron ore climbed to its highest in a month final week after a rally that has defied deepening gloom over China’s debt-laden economic system. Costs have largely saved above the important thing $100-a-ton threshold this 12 months regardless of waves of worrying information from the true property sector, which in additional regular years makes up about 40% of demand.

Commercial 2

Article content material

Article content material

The absence of a value crash or devastating stoop in metal demand illustrates how pockets of China’s economic system are holding up regardless of the destructive headlines. There are nonetheless loads of dangers forward for iron ore, not least the prospect of a chronic stoop within the property sector. However comparatively strong costs supply a counterpoint to the prevailing bearish temper throughout Chinese language markets.

“Iron ore continues to be very resilient for an surroundings like this, and I believe Chinese language demand is taking part in a job in that,” stated Hao Hong, chief economist at Develop Funding Group. It exhibits elements of the economic system, outdoors the property sector, are comparatively wholesome, he stated.

Whereas the Shanghai Composite Index of shares fell to its lowest this 12 months final week — prompting authorities steps to regular the market — iron ore futures rose to as excessive as $114 a ton. Within the final main stoop of 2015-16, costs sank beneath $40 a ton, and China’s metal surplus flooded onto the world market, fueling commerce tensions.

This doesn’t imply China’s economic system will escape a marked slowdown in development, or that iron ore costs will proceed at these ranges. Property development is falling, particularly in less-developed inland cities. And President Xi Jinping’s authorities is holding off on the large-scale stimulus, together with infrastructure spending, that has sometimes lifted metal consumption throughout earlier episodes of financial stress.

Article content material

Commercial 3

Article content material

Learn Extra: China’s Faltering Development Dangers Derailing Commodities Demand

BHP Group, the world’s second-biggest iron ore producer, stated it’s seeing “strong demand from infrastructure, energy equipment, autos and delivery, offsetting weak spot in new housing begins and development equipment.” Consultancy Kallanish Commodities Ltd. provides “white items” to that listing, a class that features merchandise like fridges and washing machines.

Railway Growth

Whereas many native governments are slowing spending because of monetary strains, central authorities funding on infrastructure like railways is rising extra quickly.

Spending development on railways is working at 25% year-on-year within the first seven months of 2023. Equipment manufacturing has risen 15% and auto output has grown 12%. There’s additionally a increase within the new power sector, which isn’t negligible for metal demand. Property funding, in the meantime, contracted 7.1% within the first seven months of the 12 months.

Metal {industry} forecasts from researcher CRU Group illustrate the divergence between development and the remainder, with demand for so-called “lengthy merchandise” utilized in constructing set to fall 1.7% this 12 months. Flat merchandise, the opposite main class, will see a 3% enhance, it stated.

Commercial 4

Article content material

Analysis agency Mysteel stated demand for heavy plate utilized in ships, bridges and wind generators rose 8.1% within the first 5 months of the 12 months. The product accounts for about 10% of Chinese language metal demand. Different classes overlaying development, equipment, home equipment and automobiles have been flat or barely decrease.

And even within the property sector, there are some small indicators of optimism at the same time as debt dangers proceed to swirl across the sector, with some state-backed builders reporting a restoration in gross sales volumes.

The general result’s a market that’s “mendacity flat,” in response to Jiang Dangle, head of buying and selling and analysis at Yonggang Assets Co. — a reference to the much-discussed social phenomenon the place residents do the minimal to get by. Mills aren’t increase a lot stock, however they’re nonetheless shopping for when obligatory to satisfy instant demand, he stated.

Manufacturing Curbs

The resilience in metal demand and iron ore costs can be being pushed by some industry-specific elements.

Metal exports have soaked up some further materials, and shipments from China are on observe to achieve their highest since 2016, though volumes are nonetheless effectively wanting the portions that irked commerce companions at the moment.

Commercial 5

Article content material

Iron ore has been helped by cuts at electrical arc furnaces that use scrap — another manufacturing technique for metal. That’s helped maintain output derived from iron ore comparatively strong. Common every day manufacturing of molten iron from blast furnaces has reached its highest since 2020, in response to Mysteel.

Steelmakers and merchants are additionally shopping for up iron ore in anticipation of the seasonal carry to development exercise that happens after the summer season. And mills might be elevating their output now to protect towards the potential for government-ordered manufacturing curbs later within the 12 months.

“Iron ore costs have deviated a bit from financial fundamentals, largely because of a scarcity of self-discipline at mills,” stated Xu Xiangchun, an analyst with Mysteel. “China’s economic system isn’t that promising.”

For the remainder of this 12 months, whether or not China avoids extra turmoil within the property sector is prone to be the decisive issue for costs. The insecurity within the non-public sector, and the hazards of local-government debt stress spreading to different elements of the economic system, are additionally sturdy headwinds.

“China can’t reignite the fireplace underneath actual property and it appears prefer it doesn’t wish to,” stated Tomas Gutierrez, an analyst at Kallanish Commodities. “It does seem like there’s a fairly strong ground for iron ore at $100 within the brief time period, however longer-term the outlook is weaker.”

—With help from Tom Hancock.

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve enabled electronic mail notifications—you’ll now obtain an electronic mail if you happen to obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra info and particulars on how you can alter your email settings.

Be a part of the Dialog