[ad_1]

The Federal Reserve is predicted to pause its interest-rate hikes Wednesday for the second time this yr following a slowing in inflation whereas leaving the door open for one more improve as early as November.

![hj7jm58aiir)afett3as]kcd_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/09/fomc-may-project-higher-for-longer-rates-as-inflation-persis.jpg?quality=90&strip=all&w=288&h=216&sig=5-nY_UJB4hlXzyiUo64ZpA)

Article content material

(Bloomberg) — The Federal Reserve is predicted to pause its interest-rate hikes Wednesday for the second time this yr following a slowing in inflation whereas leaving the door open for one more improve as early as November.

The Federal Open Market Committee will preserve charges regular at its Sept. 19-20 assembly in a spread of 5.25% to five.5%, a 22-year excessive. The speed resolution and committee forecasts will likely be launched at 2 p.m. in Washington. Chair Jerome Powell will maintain a press convention half-hour later.

Commercial 2

Article content material

Article content material

Powell has signaled that Fed leaders would like to attend to judge the affect of previous will increase on the financial system as they close to the top of their rate-hiking marketing campaign. With inflation nonetheless properly above the committee’s 2% goal and the US financial system resilient, officers might pencil in yet another hike of their quarterly projections.

“They aren’t assured sufficient to say they’ve conquered inflation,” stated Julia Coronado, founding father of MacroPolicy Views LLC and a former Fed economist. “It’s nonetheless too excessive. So that you simply preserve your choices open. I don’t suppose Chair Powell goes to present us the all-clear.”

What Bloomberg Economics Says…

“A charge maintain on the Sept. 19-20 assembly is a foregone conclusion. Nonetheless, the combined information over the inter-meeting interval imply the following transfer on the Oct. 31-Nov. 1 assembly is much less clear. We count on the up to date dot plot launched this week to point the median FOMC participant sees yet another charge hike in 2023, however it is going to be an in depth name.”

— Anna Wong, Stuart Paul and Eliza Winger, economists

To learn the complete notice, click on right here

FOMC Forecasts

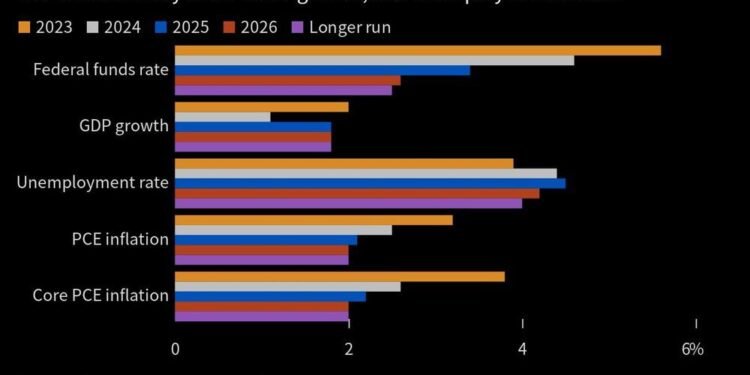

Wall Avenue will likely be targeted on whether or not Fed officers’ forecasts for rates of interest, the so-called dot plot, present the committee appears decided to hike once more.

Article content material

Commercial 3

Article content material

The central financial institution is split between extra dovish policymakers who’re able to preserve charges regular the remainder of the yr and hawks who wish to nudge them as much as 5.6% or extra.

Economists surveyed by Bloomberg count on the median projection will present yet another improve this yr and a number of other of them count on a trimming of the variety of cuts for 2024.

The committee might increase its forecast for 2023 development to about 2%, double its view from June, and search for a firmer labor market with much less unemployment this yr.

“We predict the Fed has delivered sufficient and the funds charge is sufficiently restrictive,” stated Rubeela Farooqi, chief US economist at Excessive Frequency Economics. “But when the labor market doesn’t soften and there are upside surprises on inflation, then there’s a threat the Fed will push charges even greater.”

Fed officers will even give their first financial projections for 2026 and replace their view of the impartial or long-term rate of interest, which some economists count on might rise above the two.5% estimated in June.

FOMC Assertion

The majority of the post-meeting assertion is more likely to be practically an identical to the July assertion, retaining a mountain climbing bias and not using a agency dedication to extra charge will increase. The committee is more likely to proceed to explain development as reasonable, although it might tweak its description of the labor market, which has develop into much less overheated in latest months.

Commercial 4

Article content material

Governor Adriana Kugler, the central financial institution’s first Hispanic policymaker, will likely be becoming a member of the committee following her affirmation. No dissents are anticipated.

Press Convention

Powell, in his press convention, will likely be pressed on whether or not he expects one other charge improve this yr and if he agrees with the speed forecasts within the dot plot.

He’s more likely to emphasize that Fed officers will “keep the course” till inflation is below management, stated Stifel Monetary Corp. chief economist Lindsey Piegza.

“He desires to maintain choices open and the very last thing he desires is for the market to cost in charge cuts by early 2024,” she stated.

The chair can be more likely to be quizzed on upcoming challenges to US development together with a latest improve in vitality costs, the prospect of a authorities shutdown in October and the resumption of student-loan repayments.

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We now have enabled electronic mail notifications—you’ll now obtain an electronic mail when you obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra info and particulars on methods to alter your email settings.

Be part of the Dialog