[ad_1]

Dangerous non-public credit score lending is weak to larger rates of interest and debt crunches, in keeping with watchdogs throughout the globe which are looking for extra transparency from the business.

Article content material

(Bloomberg) — Dangerous non-public credit score lending is weak to larger rates of interest and debt crunches, in keeping with watchdogs throughout the globe which are looking for extra transparency from the business.

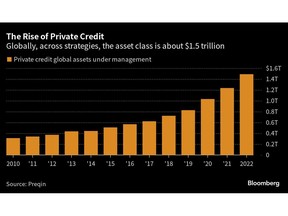

The Worldwide Financial Fund weighed in on the dangers to monetary stability from the fast-growing $1.5 trillion asset class, saying transparency wants to enhance and that extra knowledge must be collected, together with on cross-border exposures.

Commercial 2

Article content material

Article content material

Non-public credit score is a “outstanding” instance of a market “vulnerable to substantial corrections due to the lagged results of upper rates of interest,” the IMF mentioned in a report on Tuesday. “Vulnerabilities” in that market, amongst others, might “pose dangers to banks” in addition to different lenders.

The warnings come after Moody’s Traders Service mentioned final month that competitors amongst banks and direct lenders for offers within the leveraged buyout area will possible end in extra defaults. Any race to the underside on phrases and pricing might have wider systemic threat implications, the rankings firm mentioned. Elements of the US non-public credit score market have used better leverage to spice up returns, that means the risk there may very well be extra substantial, the Financial institution of England warned in July.

“The business has been rising rapidly and it’s attracting consideration as a result of it’s now an necessary a part of the financial system,” mentioned Stuart Brinkworth, a accomplice at authorized agency Mayer Brown. “However regulators battle to grasp the asset class and due to that the inclination is to imagine that extra regulation have to be the reply.”

Article content material

Commercial 3

Article content material

Non-public credit score, dominated by the likes of Blackstone Group and Ares Administration Corp., boomed as heavier regulation noticed banks retrench after the monetary disaster, opening up a possibility for direct lenders. They’ve been notably energetic in leveraged buyout loans, profiting from the large progress in mergers and acquisitions by non-public fairness corporations over the previous decade.

The asset class is safer than its status for opacity suggests, executives on the lenders say, as a result of cash managers who put money into the funds know the dangers and their publicity to the asset class is normally a small fraction of their wider portfolio. Traders within the funds are usually tied up for years, that means they will’t simply withdraw their cash on quick discover.

Nonetheless, some watchdogs are proactively introducing new measures to restrict the opportunity of contagion during times of market turmoil.

The BOE, for instance, plans to develop a everlasting backstop facility for non-banks, together with funding automobiles, which generally encompasses non-public credit score. The ability could be accessible in occasions of stress to alleviate any dangers to monetary stability.

Commercial 4

Article content material

Earlier this 12 months, the European Union reached an settlement on new guidelines for personal debt funds and different different asset managers that may require them to boost liquidity administration. That may support any fund managers coping with giant outflows throughout occasions of economic turbulence, in keeping with the July assertion.

“We imagine the EU would be the outlier,” mentioned Jiří Król, deputy chief government officer on the Different Funding Administration Affiliation. “Most world jurisdictions will keep away from imposing prescriptive guidelines of this sort on non-public credit score funds.”

If extra laws are launched, then the largest influence is more likely to come within the type of prices and decrease returns quite than modifications to deal sizes or buildings, insiders say.

“Extra regulation and extra administrative burden goes to price cash and it’s possible that traders will primarily be those to bear that price,” mentioned Artwork Penn, the founding father of PennantPark Funding Advisers, which oversees about $6.6 billion.

Week in Evaluate

- Non-public credit score lenders are in talks to supply round $2 billion of debt financing to assist a possible buyout of CCC Clever Options Holdings Inc., a car-insurance software program supplier.

- Two of the world’s greatest non-public credit score corporations have launched funds that may take far much less revenue than is common for the business — one other signal of how energy has began shifting towards traders on this $1.5 trillion market.

- Non-public credit score managers are quietly offering report loans to present debtors looking for small acquisitions, stealthily constructing the worth of their lending portfolios whereas including extra concentrated dangers.

- Antares Capital is weighing an acquisition of European rival Hayfin Capital Administration, a mixture that will create a brand new non-public credit score behemoth.

- HSBC is contemplating whether or not to enter Europe’s $300 billion collateralized mortgage obligation market as an arranger.

- Non-public lenders are seeing an uptick in demand for area of interest capital reduction trades, in keeping with Magnetar Capital’s David Snyderman.

- A handful of European firms have stepped away from their plans to promote junk debt not too long ago, underscoring the problem of attempting to navigate turbulent markets.

- Europe’s booming leveraged mortgage market simply had a actuality verify with the primary halted transaction since a world banking disaster upended markets again in March.

- A lender-appointed receiver has taken steps to imagine management of a Byju’s unit in Singapore following months of failed negotiations with what was as soon as one in all India’s hottest tech startups.

- Indian conglomerate Hinduja Group is in talks with non-public credit score funds to lift about $800 million to again the acquisition of Reliance Capital.

- Non-public credit score investments in India might double within the subsequent two years, the top of BPEA Credit score Group forecasts.

- Hillhouse, the funding agency began with backing from Yale College’s endowment, is getting ready to pitch a brand new Asia-focused non-public credit score fund to worldwide traders.

Commercial 5

Article content material

On the Transfer

- Khalid Krim, head of Credit score Suisse’s EMEA debt capital markets desk, is leaving the financial institution after 5 years.

- Monarch Different Capital has employed Karan Malhotra as its head of structured credit score buying and selling.

- David Bourne, a managing director on the funding grade syndication and origination debt capital markets desk at TD Securities, is leaving the financial institution.

- HSBC Holdings Plc is assembling a workforce of bankers to attach its company purchasers with the quickly increasing world of personal credit score.

- Financial institution of Nova Scotia not too long ago employed three bankers from HSBC Holdings Plc in Canada to beef up its fixed-income syndication and buying and selling desks.

- James Keller is becoming a member of Goldman Sachs in early December in its structured finance division.

- BNP Paribas SA employed two bankers who beforehand labored at Credit score Suisse to affix its credit score desks.

—With help from Dan Wilchins.

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve enabled e mail notifications—you’ll now obtain an e mail when you obtain a reply to your remark, there’s an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Community Guidelines for extra data and particulars on modify your email settings.