[ad_1]

With the record of stock-market worries rising seemingly by the day, traders trying to earnings season for a dose of fine information are hanging their hopes on a well-recognized group: Huge Tech.

![kahxi91zd87du1n]n91keusi_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/10/3q-profit-growth-estimates-in-sp-500.jpg?quality=90&strip=all&w=288&h=216&sig=z6xNESVwMrGldNYALRNuGw)

Article content material

(Bloomberg) — With the record of stock-market worries rising seemingly by the day, traders trying to earnings season for a dose of fine information are hanging their hopes on a well-recognized group: Huge Tech.

After slashing hundreds of jobs to chop prices, the most important US know-how and web firms are pumping out income just like these generated two years in the past when the pandemic despatched gross sales of digital companies and digital units hovering. The expectation now could be that they’ll assist decide up the slack from industries like vitality and well being care which might be nonetheless mired in an earnings stoop.

Commercial 2

Article content material

Article content material

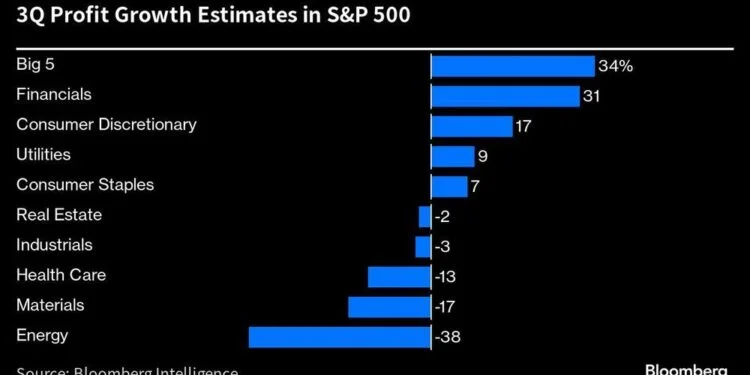

The 5 largest firms within the S&P 500 Index — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Nvidia Corp. — account for a couple of quarter of the benchmark’s market capitalization. Their earnings are projected to leap 34% from a 12 months earlier on common, based on analyst estimates compiled by Bloomberg Intelligence.

The S&P 500 as an entire isn’t trying almost as robust. The index’s income are anticipated to be roughly flat, however they’d face a drop of round 5% with out these 5 behemoths.

“It’s crucial for the massive tech shares to ship” and bolster confidence broadly, mentioned Gary Bradshaw, a portfolio supervisor at Hodges Capital Administration. “The Road expects earnings to be good throughout the board. Megacap tech shares have no matter it takes to steer the market within the ultimate quarter of the 12 months.”

Main the Market

Hovering rates of interest have rattled markets this month with the 10-year Treasury yield hitting the best in additional than a decade. A warmer-than-expected inflation report has traders bracing for the Federal Reserve to maintain coverage tight, and doubtlessly hike once more. That backdrop has reignited fears a couple of potential recession which have solely been heightened by battle within the Mideast.

Article content material

Commercial 3

Article content material

Tech shares have faltered within the face of these headwinds, with the tech-heavy Nasdaq 100 tumbling for 2 straight months. However they’ve nonetheless massively outperformed the general market. The 5 key big-tech firms account for the majority of the S&P 500’s 13% advance this 12 months.

Netflix Inc. and Tesla Inc. are scheduled to kick off tech-related earnings Wednesday. Alphabet, Microsoft, Amazon and Meta Platforms Inc. report the next week. Apple pronounces Nov. 2 and Nvidia on Nov. 21.

After sturdy second-quarter earnings, “we have to see extra of the identical within the third-quarter outcomes,” mentioned Mike Bailey, director of analysis at FBB Capital Companions. Given their huge weighting, “you may wager that the remainder of the market will play observe the chief as huge tech earnings unfold this quarter.”

He mentioned he sees “pretty low odds of a tech earnings wreck this quarter.”

Traders have good cause to be optimistic. Previously century, the S&P 500 has rallied throughout reporting season about two-thirds of the time, knowledge compiled by Bloomberg present.

Roadblocks Forward

One potential roadblock to an earnings-fueled rally is that lots of the anticipated excellent news could also be priced in. Alphabet and Amazon have gained greater than 50% this 12 months, whereas Apple and Microsoft have superior almost 40%.

Commercial 4

Article content material

On high of rising revenue expectations, the shares have benefited from bets that the tech giants are finest positioned to capitalize on generative synthetic intelligence. That’s regardless of Nvidia, whose shares have tripled this 12 months, being the one one to point out a considerable monetary increase from the development.

A supply of concern for traders is that even with latest declines, huge tech’s stock-market valuations are nonetheless elevated. Apple and Microsoft are priced at about 27 and 29 occasions estimated earnings, respectively, nicely above averages over the previous decade. That determine is round 18 for the S&P 500 as an entire.

Costly share costs put stress on firms to ship robust earnings, based on Kim Forrest, founder and chief funding officer at Bokeh Capital Companions.

“They should continuously ship or they are going to lose the eye of traders,” she mentioned in an interview. “Anyone must hold shopping for, and these wealthy valuations should be justified.”

Article content material

[ad_2]

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve got enabled e mail notifications—you’ll now obtain an e mail when you obtain a reply to your remark, there may be an replace to a remark thread you observe or if a person you observe feedback. Go to our Community Guidelines for extra data and particulars on tips on how to regulate your email settings.