[ad_1]

Even the most effective investor on earth makes unsuccessful investments. However critical buyers ought to suppose lengthy and arduous about avoiding excessive losses. It will need to have been painful to be a AMC Leisure Holdings, Inc. (NYSE:AMC) shareholder during the last 12 months, for the reason that inventory value plummeted 85% in that point. That’d be a placing reminder concerning the significance of diversification. To make issues worse, the returns over three years have additionally been actually disappointing (the share value is 38% decrease than three years in the past). Shareholders have had a fair rougher run recently, with the share value down 64% within the final 90 days. We actually hope anybody holding by way of that value crash has a diversified portfolio. Even if you lose cash, you do not have to lose the lesson.

Whereas the inventory has risen 4.4% prior to now week however long run shareholders are nonetheless within the purple, let’s examine what the basics can inform us.

AMC Leisure Holdings is not presently worthwhile, so most analysts would look to income development to get an thought of how briskly the underlying enterprise is rising. Shareholders of unprofitable firms normally anticipate robust income development. As you may think about, quick income development, when maintained, usually results in quick revenue development.

AMC Leisure Holdings grew its income by 344% during the last 12 months. That is properly above most different pre-profit firms. So on the face of it we’re actually shocked to see the share value down 85% over twelve months. One thing bizarre is certainly impacting the inventory value; we might enterprise the corporate has destroyed worth by some means. We would advocate taking a really shut take a look at the inventory (and any out there forecasts), earlier than contemplating a purchase order, as a result of the share value is not correlated with the income development, that is for positive. After all, buyers do over-react when they’re wired, so the sell-off might be unjustifiably extreme.

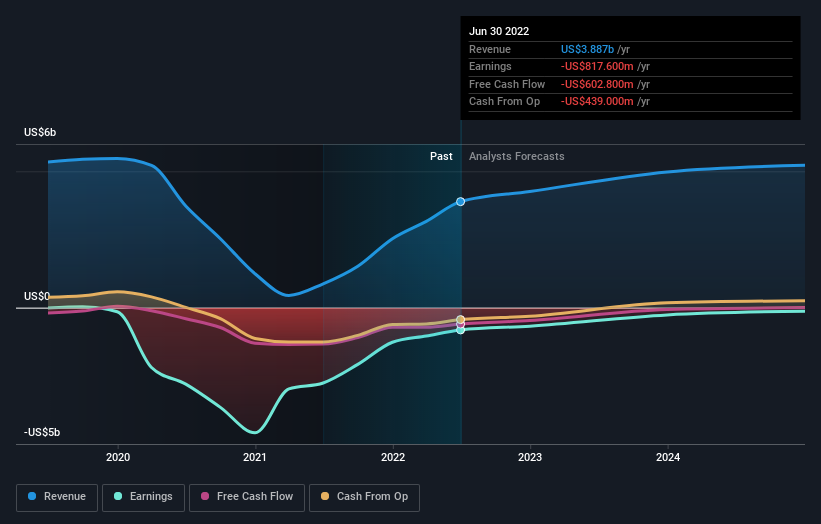

You possibly can see beneath how earnings and income have modified over time (uncover the precise values by clicking on the picture).

You possibly can see how its steadiness sheet has strengthened (or weakened) over time on this free interactive graphic.

What About The Complete Shareholder Return (TSR)?

Traders ought to observe that there is a distinction between AMC Leisure Holdings’ whole shareholder return (TSR) and its share value change, which we have coated above. Arguably the TSR is a extra full return calculation as a result of it accounts for the worth of dividends (as in the event that they had been reinvested), together with the hypothetical worth of any discounted capital which have been supplied to shareholders. AMC Leisure Holdings’ TSR of was a lack of 76% for the 1 12 months. That wasn’t as unhealthy as its share value return, as a result of it has paid dividends.

A Completely different Perspective

We remorse to report that AMC Leisure Holdings shareholders are down 76% for the 12 months. Sadly, that is worse than the broader market decline of 24%. Having mentioned that, it is inevitable that some shares can be oversold in a falling market. The hot button is to maintain your eyes on the basic developments. Regrettably, final 12 months’s efficiency caps off a nasty run, with the shareholders going through a complete lack of 2% per 12 months over 5 years. We realise that Baron Rothschild has mentioned buyers ought to “purchase when there’s blood on the streets”, however we warning that buyers ought to first make sure they’re shopping for a top quality enterprise. It is all the time fascinating to trace share value efficiency over the long term. However to grasp AMC Leisure Holdings higher, we have to take into account many different elements. To that finish, it is best to be taught concerning the 3 warning signs we’ve spotted with AMC Entertainment Holdings (including 2 which make us uncomfortable) .

However observe: AMC Leisure Holdings will not be the most effective inventory to purchase. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please observe, the market returns quoted on this article mirror the market weighted common returns of shares that presently commerce on US exchanges.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by elementary knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

[ad_2]

Source link